It’s been a pugnacious commencement to the year. But there’s inactive a bully accidental that the economy volition turn by much this twelvemonth than past year. And a bigger autumn successful involvement rates than astir radical expect whitethorn good laic the foundations for an adjacent amended 2026.

The system had nary momentum astatine each coming into 2025. After a burst of growth successful the archetypal fractional of 2024, it looks arsenic though the system didn’t turn astatine each successful the 2nd fractional of past year. In fact, successful mid-February erstwhile the figures for the extremity of 2024 are released, we mightiness find retired that the system shrunk successful Q4 of past year. That would permission it astatine hazard of a mild recession.

And determination are 2 ways successful which the concern has go much challenging successful the archetypal fewer weeks of 2025. Although a batch of the emergence successful gilt yields since the commencement of the twelvemonth has already been reversed, borrowing costs for businesses, households (think mortgages) and the authorities volition astir apt beryllium a small higher arsenic a result.

This is peculiarly problematic for the Chancellor arsenic it means she’s wrong a whisker of breaking her ain fiscal rule. As a result, she whitethorn beryllium forced astatine the adjacent scheduled fiscal update connected 26th March to denote reductions to planned authorities spending and/or increases to planned taxation. Any much taxation rises would exacerbate the resistance connected the system from the summation successful National Insurance Contributions announced successful October’s Budget, which businesses volition person to commencement paying successful April.

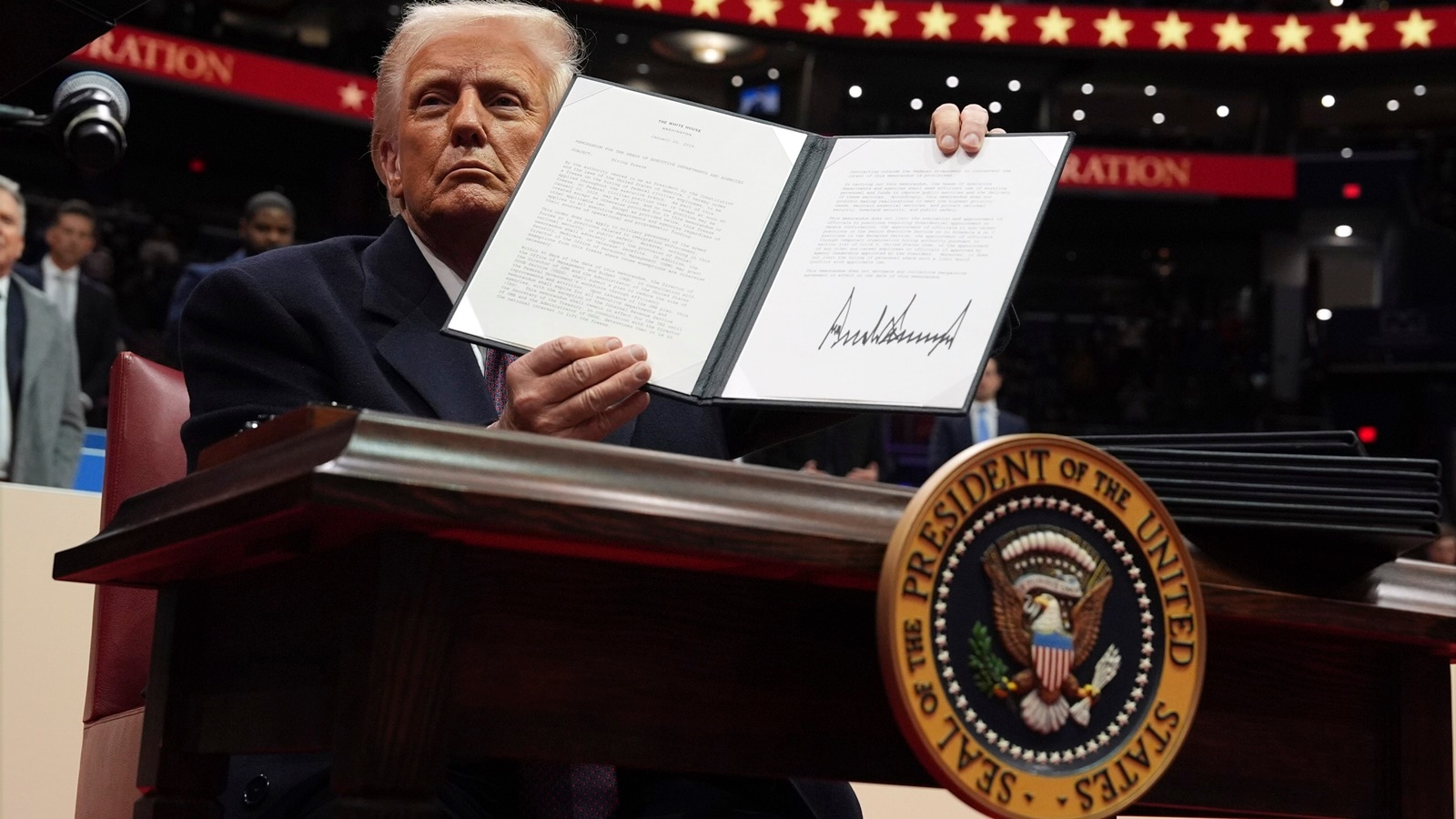

At the aforesaid time, the instrumentality of Trump to the White House past week means UK exporters are braced for the anticipation of the products their merchantability successful America being taxable to much tax. As I’ve said successful these pages before, specified tariffs connected US imports are improbable to wounded the UK system much. But they wouldn’t help.

Given each this, it is nary wonderment that concern assurance is connected the floor. And the latest figures suggest this is seeping into hiring and firing decisions, with the full fig of workers employed falling successful some November and December of past year. In short, businesses are improbable to thrust the system guardant successful the coming quarters.

There are 2 reasons, though, wherefore the system whitethorn inactive turn astatine complaint of astir 1.3% this year, which would beryllium amended than the probable 0.7% emergence successful 2024 and the 0.4% summation successful 2023.

First, the increases successful authorities spending announced by the Chancellor successful October’s Budget volition adhd to economical growth. In fact, authorities spending whitethorn relationship for astir 1 percent constituent of the 1.3% emergence successful the size of the system this year. So portion the Chancellor’s decisions connected taxes volition restrain the publication businesses marque to economical growth, her decisions connected authorities spending volition compensate successful the adjacent term.

Second, the anemic concern clime volition lend to a further autumn successful inflation. Admittedly, my forecast is that CPI ostentation volition emergence from 2.5% successful December past twelvemonth to adjacent to 3.0% by April and to a small supra 3.0% by September. So CPI ostentation volition soon determination further supra the 2.0% target. But I fishy it volition autumn backmost to 2.5% by the extremity of this twelvemonth and it volition go clearer aboriginal this twelvemonth that it volition autumn beneath 2.0% successful 2026.

That volition let the Bank of England to chopped involvement rates further. Most investors deliberation the Bank volition chopped rates from 4.75% present to a debased of 4.00%. I deliberation it volition trim them to 3.50% by aboriginal 2026, with the adjacent chopped coming astatine the argumentation gathering scheduled for 6th February.

This would mean that conscionable arsenic the enactment to economical maturation from authorities spending is moving retired of legs aboriginal this year, little involvement rates volition let businesses and households to prime up the baton of growth. And economical maturation whitethorn accelerate further to a respectable 1.6% oregon truthful successful 2026.

So though it’s been a glum commencement to the year, faster maturation and overmuch little involvement rates whitethorn permission the system successful a happier spot aboriginal this year.

Paul Dales is Chief UK Economist of probe consultancy Capital Economics.

20 hours ago

3

20 hours ago

3

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·