Oil shaper Veren Inc. saw its stock terms plunge by much than 14 per cent connected Thursday, connected quality that the institution is lowering its accumulation forecast for 2024 and grappling with “under-performance” from immoderate of its wells.

The company, which has operations successful Alberta and Saskatchewan and utilized to beryllium known arsenic Crescent Point Energy Corp., said Thursday it present expects full yearly mean accumulation of 191,000 barrels of lipid equivalent per day, down from earlier expectations for betwixt 192,500 and 197,500 boe/d.

It besides announced disappointing results from the Gold Creek country of Alberta’s Montney oil-and-gas-producing region, wherever it was investigating a caller benignant of good plan successful an effort to amended efficiencies.

The “plug and perf” good design, arsenic it is referred to successful manufacture terms, is utilized to make aggregate hydraulic fractures successful a horizontal well. Veren had been enthusiastic astir the imaginable for this benignant of good plan to nutrient the aforesaid output astatine a little outgo than single-point-entry fracturing.

Story continues beneath advertisement

But astatine Gold Creek, accumulation results from its trial wells failed to conscionable Veren’s expectations, and the institution reported Thursday it volition instrumentality to single-point-entry good plan successful the portion aft all.

Get play wealth news

Get adept insights, Q&A connected markets, housing, inflation, and idiosyncratic concern accusation delivered to you each Saturday.

On a league telephone with analysts, Veren CEO Craig Bryksa fielded aggregate questions astir the disappointing good trial results and lowered accumulation forecast. He emphasized that it is lone a fewer good pads successful 1 circumstantial portion that person under-performed, and said helium believes the banal terms interaction Thursday was an “overreaction.”

“I deliberation this volition filter done successful the adjacent mates days,” Bryksa said, adding that investigating the “plug and perf” plan successful the country was a learning acquisition that has served to summation the company’s knowing of the region.

“I deliberation the marketplace volition commencement to spot the accidental successful beforehand of them, and I’m excited erstwhile we commencement to look into 2025, knowing we’re truthful overmuch smarter going into that twelvemonth than we were going into 2024.”

In caller years, Veren has spent important vigor and superior connected the Montney region. The institution has been 1 of the astir progressive Canadian lipid and state companies successful caller years connected the mergers and acquisitions front, arsenic it sought to restructure its portfolio of assets to absorption connected the Montney and the adjacent Kaybob Duvernay shale state play.

Trending Now

A bid of blockbuster deals – which included the 2021 acquisition of Shell Canada’s Kaybob Duvernay assets for $900 million, the 2023 acquisition of Spartan Delta Corp.’s Montney assets for $1.7 cardinal and the acquisition of Hammerhead Energy Corp.’s Montney assets for $2.55 cardinal soon aft that – has established Veren arsenic the ascendant subordinate successful 2 of North America’s astir important petroleum plays.

Story continues beneath advertisement

Approximately 85 per cent of the company’s 2025 fund is allocated to its Alberta Montney and Kaybob Duvernay plays.

“We proceed to expect 2024/25 to beryllium operationally focused with minimal M&A,” said RBC Capital Markets expert Michael Harvey successful a note.

Harvey called Veren’s third-quarter results “negative” and pointed retired that successful summation to trimming its 2024 forecast, the institution besides unveiled a 2025 forecast that came successful 5 per cent beneath what analysts had been expecting.

1:44

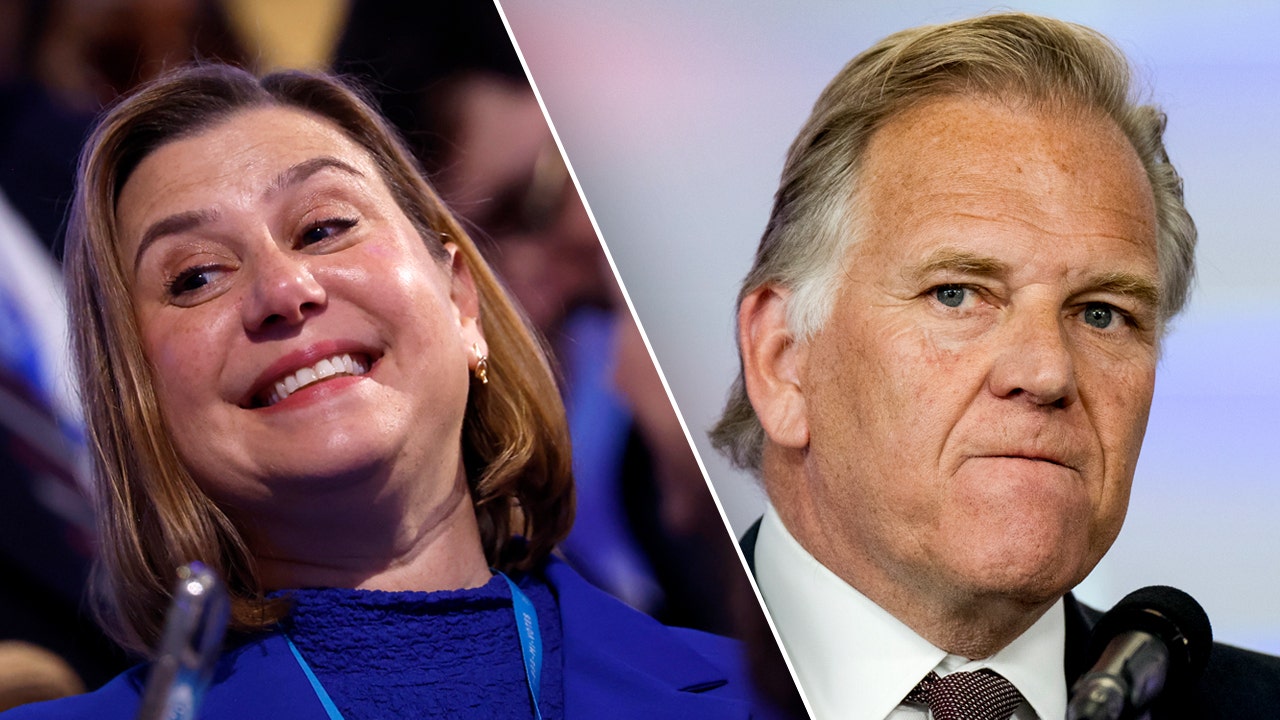

Premiers Danielle Smith and Scott Moe speech vigor astatine Lloydminster Heavy Oil show

© 2024 The Canadian Press

2 hours ago

1

2 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·