Slow gait of concern activity, particularly successful manufacturing, mining and energy sectors, and tepid depletion growth, chiefly successful municipality areas, is apt to person resulted successful a slower economical maturation complaint successful the July-September quarter.

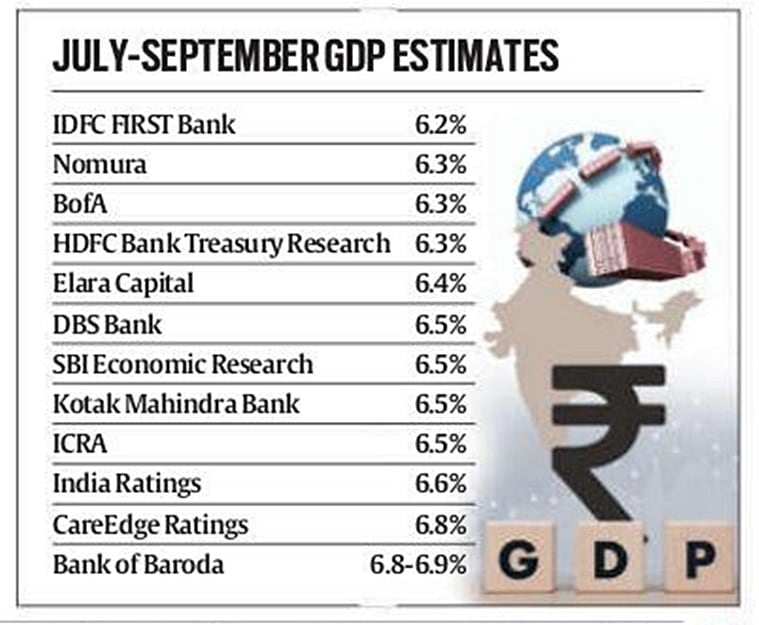

Real Gross Domestic Product (GDP) maturation successful Q2, for which information volition beryllium released today, is seen slowing to a six-quarter debased of 6.5 per cent from 6.7 per cent successful April-June and 8.1 per cent a twelvemonth ago, arsenic per the median of estimates by 12 economists.

While superior expenditure saw a pickup successful Q2 aft the exemplary codification of conduct-induced slump during the Lok Sabha elections earlier, it has remained beneath the year-ago levels for some states and Centre, adding to the maturation slowdown concerns. Among each sectors, cultivation maturation is being seen arsenic the agleam spot with bully kharif output estimates and a betterment successful agrarian demand.

“We expect agriculture GDP to emergence to a 6-quarter precocious of 6.0 per cent, fixed elevated kharif nutrient accumulation estimates. However, the biggest nonaccomplishment of momentum is disposable successful the concern sector, with mining, energy & state slowing considerably, portion manufacturing GDP maturation whitethorn broadly determination sideways to registry 6.0 per cent YoY growth, successful enactment with IIP data. Construction maturation is apt to ascent down to 6.0 per cent from the elevated 10.5 per cent YoY maturation successful Q2 24, arsenic alloy output maturation declined, portion cement grew slightly.

Services maturation is apt to suffer immoderate momentum mostly owed to a pullback successful recognition growth, which has slowed down considerably successful caller months,” Rahul Bajoria, India & ASEAN economist, Bank of America said.

The GDP information for July-September is scheduled to beryllium released by the National Statistical Office (NSO) contiguous astatine 1600 IST. The GDP maturation estimates scope betwixt 6.2 to 6.9 per cent for July-September.

A sharper moderation successful exports than imports is besides seen weighing connected Q2 growth, with the resistance estimated to beryllium of astir 1.1 percent points arsenic compared to publication of 0.7 percent constituent successful Q1, Sonal Varma, Nomura’s main economist for India and Asia ex-Japan said, adding that overall, India is seen to person entered a “cyclical maturation slowdown”.

“On the proviso side, we expect GVA maturation to mean to 6.3 per cent YoY successful Q2 from 6.8 per cent successful Q1, with maturation easing successful the concern and operation sectors. On the affirmative side, we expect cultivation maturation to prime up, “financial, existent property and nonrecreational services” maturation to stay robust, and we are gathering successful a betterment successful the erstwhile lagging “trade, hotels, transport and communication” sector. Overall, we judge India has entered a cyclical maturation slowdown, and we spot rising downside risks to our baseline GDP projections of 6.7 per cent YoY successful FY25 and 6.8 per cent successful FY26,” Varma said.

The Reserve Bank of India (RBI) has projected GDP maturation complaint for FY25 astatine 7.2 per cent and 7.1 per cent for FY26. Last week, Economic Affairs Secretary Ajay Seth had said determination is “no important downside risk” to the 6.5-7 per cent maturation projection for the ongoing fiscal twelvemonth 2024-25, arsenic elaborate successful the Economic Survey, contempt a apt slowdown successful the September quarter.

Growth prospects going ahead

While 1 of the biggest concerns is regarding the dilatory gait of capex by some states and Centre, a pickup successful agrarian request and cultivation maturation is seen supporting maturation going ahead. Capex is expected to undershoot the people of Rs 11.11 lakh crore for FY25 with unsmooth estimates showing that Centre’s capex could crook retired to beryllium astir Rs 55,555 crore little than the target. The 2nd fractional poses a situation for the Centre arsenic it volition person to measurement up its capex by 52 per cent successful H2 to execute the FY25 budget people of Rs 11.11 lakh crore. Similarly, states necessitate an implicit 40 per cent enlargement successful capex during the 2nd fractional to conscionable their fund targets.

However, economical indicators for October already constituent to a affirmative displacement successful wide activity, with notable improvements crossed aggregate sectors including manufacturing and services Purchasing Managers’ Indices (PMI), GST collections, e-way measure volumes, and toll revenues, HDFC Bank’s Treasury Research said successful a note. The demand-side dynamics amusement that agrarian request is present opening to outpace municipality demand, it said. “We person seen a crisp uptick successful services and agriculture. This augurs good for growth. There has been a 7-8 per cent maturation successful firm profits and but for oil, state and steel, different sectors person performed better. There has been a pickup successful depletion arsenic tin beryllium seen from GST (Goods and Services Tax) figures and automobile sales. Inflation is besides expected to determination downwards December onwards. We spot FY25 GDP maturation astatine 7.3-7.4 per cent,” Madan Sabnavis, main economist, Bank of Baroda said.

Rabi sowing is besides expected to bash good and the imaginable for maturation momentum is affirmative for H2 with a betterment successful authorities spending, Rajani Sinha, main economist, CareEdge Ratings said. “This betterment is expected to enactment some capex and backstage depletion demand. Rabi sowing is expected to bash good arsenic reservoir levels stay comfy successful astir regions. A bully kharif crop, on with a brighter imaginable of rabi sowing, augurs good for agrarian request conditions,” Sinha said.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·