India’s G20 Sherpa Amitabh Kant’s telephone for reforms successful India’s insolvency solution model to chopped delays and boost creditor betterment is latest successful the increasing chorus for making the Insolvency and Bankruptcy Code (IBC) much effective. Introduced successful 2016, the codification promised an overhaul of insolvency solution with the purpose to rescue and reorganise distressed companies done a time-bound process, prioritising their endurance arsenic going concerns.

Eight years on, portion the IBC has had a fewer successes, it is marred by issues similar precocious lawsuit backlog, lengthy delays successful admittance and resolution, and steep haircuts for creditors. In the caller past, assorted stakeholders, including RBI Governor Shaktikanta Das and the Parliament’s Standing Committee connected Finance, besides flagged concerns and the request to rethink the IBC’s design.

While the IBC has fostered a civilization of accountability and recognition subject among debtors, its ratio is being undermined by procedural delays, shortage of personnel, deviations from cardinal principles, and dilatory implementation of captious provisions.

Procedural delays

“We indispensable admit immoderate concerns regarding the contiguous functioning of the IBC, indicating a request for a 2nd procreation of reforms. Analysis of IBBI’s (Insolvency and Bankruptcy Board of India) ain information shows that insolvency resolutions astatine the National Company Law Tribunal (NCLT) averaged 716 days successful FY24, up from 654 days successful FY23,” Kant said Monday. The prescribed solution timeline is 330 days.

In February 2024, the Standing Committee connected Finance had flagged delays and their interaction connected the worth of stressed assets, and called for a reappraisal of the IBC’s design. “…the Committee judge that the plan of the Code needs to beryllium reviewed, taking into relationship the lacunae and roadblocks that person surfaced successful implementing the Code truthful far, truthful that the precise intent down its enactment is not defeated. The process of admitting claims besides needs to beryllium revisited arsenic immense delays hap astatine this signifier creating a domino effect connected the full solution process, astir critically degeneration of plus value,” the sheet said successful a report.

Das, too, had flagged the delays successful January. “More concerning is the information that, the mean clip taken for admittance of a lawsuit during FY21 and FY22 stood astatine 468 days and 650 days respectively. Such agelong grade of delays volition substantially erode the worth of the assets. There are multitude of factors playing retired here, namely, the evolving jurisprudence related to the Code; litigatory tactics adopted by immoderate firm debtors; deficiency of effectual coordination among the creditors; bottlenecks successful the judicial infrastructure, etc,” helium said.

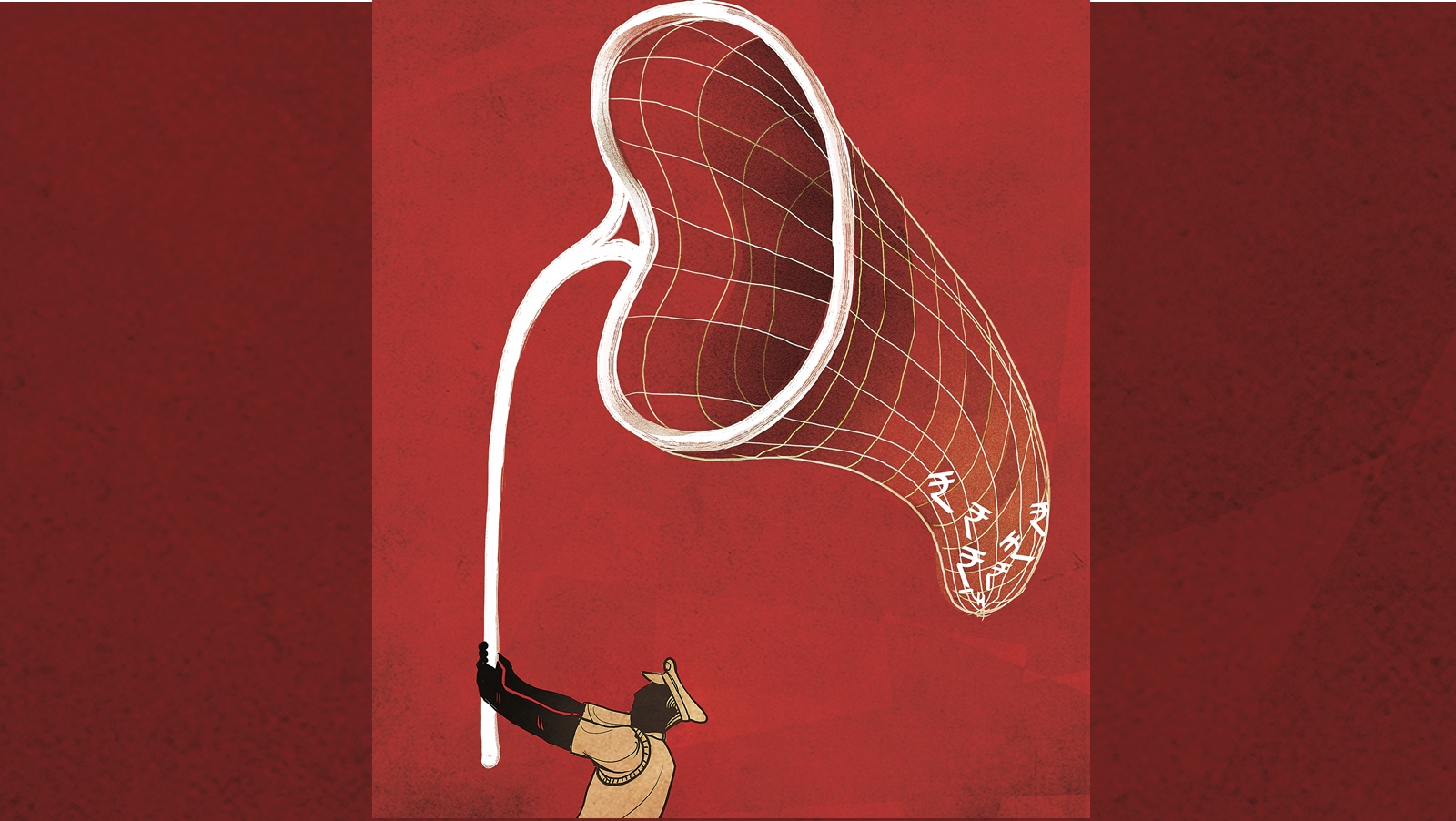

Steep haircuts

There is an inverse narration betwixt solution clip and indebtedness recovery. As of March 31, cases resolved wrong 330 days saw a betterment complaint of 49.2 per cent of admitted claims. For those resolved betwixt 330 and 600 days, the betterment complaint was 36 per cent. For those exceeding 600 days, the betterment complaint was conscionable 26.1 per cent.

Apart from worth erosion for creditors, experts reason that delays are pushing outcomes towards liquidation, defeating the process’s raison d’etre. Till March 31, liquidation orders took an mean of 673 days, compared to 847 days for solution program approvals. Of the full 5,647 proceedings that were closed, 44 per cent ended successful liquidation, 17 per cent successful solution plans getting approved, and the remaining were a premix of withdrawals and closures connected appeals, review, oregon settlement.

IBBI chairperson Ravi Mital precocious said IBC cases instrumentality clip arsenic it is simply a creditor-led model, not debtor–led, and “the debtor tries his champion to guarantee that the lawsuit is not admitted”, which leads to precocious admissions and consequently higher worth erosion and haircuts for lenders.

“We did a study…when cases are admitted into IBC, they person already mislaid much than 50 per cent of their value. Now, IBC is not liable if the creditors bring the cases late. IBC is liable erstwhile a lawsuit is brought earlier (it), and if you look astatine betterment arsenic a percent of just value, we retrieve 84 per cent,” Mital said.

Industry experts hold that admittance delays are hurting the process. Abhishek Dafria, Senior Vice President and Group Head, Structured Finance Ratings, astatine ICRA said: “We proceed to find creditors approaching the NCLT to admit a defaulting firm debtor with important delays, which results successful important erosion of assets…IBC is inactive not seen arsenic the archetypal measurement to effort and guarantee that the institution remains a going concern. Lenders are taking different approaches earlier yet turning to the IBC.”

Legal issues

While the NCLT should ideally determine connected whether a lawsuit tin beryllium admitted nether the IBC wrong 14 days of an insolvency application, it often takes months and sometimes adjacent implicit a twelvemonth to initiate insolvency proceedings. The reason, astatine slightest partly, is ineligible successful nature.

“When we talk of admittance delays, the instrumentality says it is 14 days from the day of filing (the application)…Why doesn’t it happen? The Supreme Court has held that (the timeline) is procedural successful quality and hence it is straight not mandatory. Possibly, 14 days seems to beryllium a precise abbreviated duration. Looking astatine the concern practically successful the existent environment, our existent infrastructure…14 days looks precise impractical,” a elder lawyer told The Indian Express.

In 2022, the apex tribunal had held that admittance wrong 14 days was not a mandatory proviso of the IBC and that the NCLT had discretionary powers connected deciding whether oregon not to admit the insolvency application. This means that the NCLT, alternatively of considering conscionable the default arsenic the sole ground of admission, should besides see the default’s circumstances and the debtor’s arguments.

Kant emphasised the request to “clarify ambiguity connected cardinal ineligible principles,” peculiarly regarding the supremacy of the Committee of Creditors’ (CoC) commercialized judgement and the established precedence of claims.

“The Rainbow Papers lawsuit highlighted the statutory priorities of VAT (Value Added Tax) versus IBC, stating that the CoC cannot unafraid their ain dues astatine the outgo of statutory dues owed to immoderate government. This seems to contradict the legislative intent down the IBC, which aimed for little precedence for authorities dues compared to secured lenders and fiscal institutions. A statutory amendment oregon reconsideration by a larger seat is required,” Kant said.

Human assets crunch

It is nary concealed that the strategy is choked and understaffed, with NCLT benches grappling with dense lawsuit burden. While determination has been an effort from the authorities to amended the staffing situation, it is inactive obscurity adjacent to what is needed.

In its February report, the Standing Committee connected Finance mentioned that the pendency stands astatine implicit “20,000 cases successful NCLT astatine the extremity of each year”, and called for the enhancement of the NCLT’s sanctioned strength.

“Apart from the quality assets gaps, the Committee would similar to item that the NCLT is functioning with mediocre infrastructural setup. The Committee urge that the Ministry (of Corporate Affairs) should prioritise addressing the requirements of the Tribunal urgently and capable the infrastructural and quality capableness gaps without further delay. The Committee judge that equipping the NCLT is simply a important measurement successful improving the implementation of IBC particularly successful timely solution of cases,” the study said.

The authorities is already considering amendments to the IBC aft a broad reappraisal was undertaken past year. According to Kant, India should besides see moves similar outsourcing tribunal absorption for insolvency proceedings to backstage players.

“It is often said that justness delayed is justness denied…there is simply a request for tribunal process re-engineering. It is indispensable to minimise judicial bandwidth connected administrative matters portion opening non-court functions to innovative non-sovereign oregon backstage players to deploy exertion for improved tribunal management,” helium said.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·