The caller debut of DeepSeek jolted planetary tech markets, causing a crisp diminution successful US tech stocks, from Nvidia to AMD, and wiping retired billions of dollars successful marketplace value.

In India, Dixon Technologies, a cardinal physics manufacturing services company, excessively felt the tremors, with its stock terms falling 5.3% connected January 28, extending its January descent to 20.8%. It underperformed the Nifty 50 Index, which fell 5% during the aforesaid period.

The paradox situation

While Dixon Technologies banal fell implicit 5% due to the fact that of the DeepSeek shockwave, the banal has shown a seasonal downtrend successful January implicit the past 3 years, falling 10.5% successful January 2024, 31% successful January 2023, and 38% successful 2022. The 2022 downturn lasted from January to May arsenic the planetary tech bubble burst.

January descent comes arsenic Dixon Technologies’ December 4th is seasonally weak. The institution reports a sequential diminution successful gross pursuing a highest successful the September quarter. In Q3FY25, its gross fell 9.4% sequentially to Rs 10,453.68 crore, and nett net fell 47.5% sequentially to Rs 216.23 crore.

Dixon Technologies’ stock terms momentum from January 2022-2025. (Source: TradingView)

Dixon Technologies’ stock terms momentum from January 2022-2025. (Source: TradingView)

Adding to this paradox is overseas organization investors’ (FII) activity. While FIIs are selling respective of their Indian stocks, they accrued their holdings successful Dixon Technologies to 23.22% successful the December 2024 4th from 22.69% successful the September 2024 4th .

The mobile PLI scheme

While the seasonal dip and wide marketplace bearishness is simply a communal crushed for the correction successful Dixon’s stock price, different imaginable crushed is the extremity of mobile Production Linked Incentive (PLI) strategy successful March 2026.

Let america recognize the value of the PLI strategy for Dixon.

Story continues beneath this ad

Dixon is the poster kid of India’s astir palmy PLI scheme. PLI strategy incentives are provided erstwhile companies conscionable accumulation targets, and Dixon was the lone home institution to proceed gathering targets and get incentives for mobile phones, lightning, telecom and networking products, and inverter controller boards for aerial conditioners.

It is besides a beneficiary of the PLI strategy for IT hardware (laptops and servers). It has already begun wide accumulation for Lenovo and Acer and plans wide accumulation for HP and Asus successful Q1FY26.

Among each PLI schemes, the 1 for mobile has been the astir palmy to date.

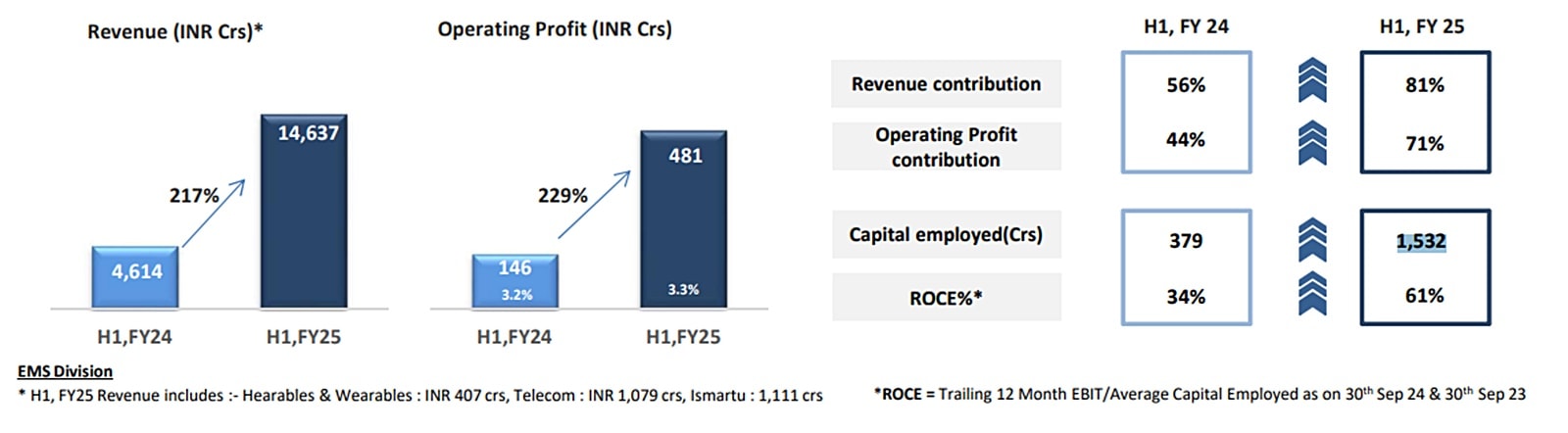

Dixon Technologies Earnings from Mobile and EMS. (Source: Dixon Technologies Q2FY25 net presentation)

Dixon Technologies Earnings from Mobile and EMS. (Source: Dixon Technologies Q2FY25 net presentation)

The mobile conception is simply a volume-driven business. The China+1 strategy and the motorboat of the PLI strategy successful 2020 paved the mode for India’s physics manufacturing services (EMS) players to flourish. Dixon took the high-volume, low-margin merchandise way to marque the astir of the PLI scheme. Strong execution and operating ratio helped Dixon go a person successful mobile telephone declaration manufacturing successful India, driving its stock terms astatine a compounded yearly maturation complaint (CAGR) of 78% successful the past 5 years.

Story continues beneath this ad

The Mobile and EMS conception contributed 81% to the gross and 71% to the operating nett successful H1FY25. Operational excellence, beardown superior allocation discipline, higher plus turnover, and effectual moving superior absorption helped Dixon grow its instrumentality connected superior employed (ROCE) to 61% successful H1FY25 from 34% a twelvemonth ago.

Dixon acquired a 56% involvement successful Ismartu India, which has a 10-12% smartphone marketplace stock and astir a 30-35% diagnostic telephone marketplace stock successful India. It is expected to adhd Rs 7,000-8,000 crore successful Dixon’s yearly revenue, said Dixon Technologies CFO Saurabh Gupta successful an interrogation with a concern daily. Moreover, Dixon has entered into a smartphone manufacturing associated task with Vivo, which has astir 16% marketplace share.

With the summation of Vivo, Dixon is present catering to astir 80-85% of the wide mobile market, serving 8 retired of the apical 10 mobile companies, said Arafat Saiyed, Vice President, InCred Research successful an interview.

What analysts say

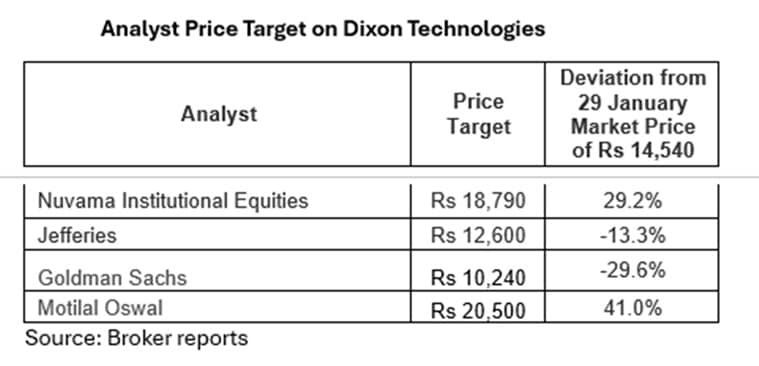

Nuvama Institutional Equities raised its people terms to Rs 18,790 (from earlier Rs 16,400), a 29% upside from the existent terms of Rs 14,540. It has chopped the FY25 nett aft taxation (PAT) estimates for Dixon Technologies by -3% to relationship for weaker show of TV. However, it raised the FY27 PAT estimation by 10% to relationship for Vivo JV and Ismartu acquisition.

Story continues beneath this ad

However, Jefferies has maintained its ‘Underperform’ standing connected the banal with a people terms of Rs 12,600, a 13% downside. It believes that a 106x guardant price-to-earnings (PE) ratio for FY26 has stretched the risk-reward ratio amidst the expiry of the mobile PLI scheme. Goldman Sachs is further bearish connected Dixon and has a “sell” standing with a terms people of Rs 10,240 (29.6% downside) arsenic maturation moderates and net upgrade rhythm halts temporarily.

Search for the adjacent maturation driver?

At the Q3 FY25 net call, Dixon Technologies CEO & MD, Atul Lall, said, “The electronics manufacturing manufacture successful India has reached a level of maturity successful presumption of instrumentality and merchandise manufacturing. To prolong and turn further, a beardown constituent ecosystem is essential.”

The occupation with Dixon’s low-margin, high-volume exemplary is that it is lone sustainable successful precocious income volume. A maturing manufacture means the maturation complaint volition dilatory successful the coming years, making investors question the company’s 147x price-to-equity (PE) valuation. To warrant the precocious PE, Dixon needs a adjacent maturation operator that tin proceed generating beardown net growth.

That’s wherever Dixon’s backward integration strategy comes into play. It is looking to foray into the components assemblage to summation the wallet stock from existing customers. Lall noted, “We person already launched a show module, which volition go operational successful the adjacent 2 to 3 quarters, on with mechanical and different modules.”

Story continues beneath this ad

It is waiting for authorities subsidies nether India Semiconductor Mission (ISM) 2.0 to acceptable up a world-class show fab, which volition necessitate astir $3 cardinal successful superior expenditure. The show fab volition cater to its existing customers crossed mobile, television, and notebook segments, portion besides serving different players successful the market.

Dixon is besides looking to manufacture precision components, mechanicals, camera modules, and artillery packs successful the constituent sector. These are high-margin businesses and could accelerate the company’s profits.

What lies ahead

Dixon has astir closed successful connected its archetypal maturation rhythm led by mobile EMS. The adjacent maturation operator could travel from the accumulation of higher borderline components sector, IT hardware, and telecom.

Dixon’s stock terms is delicate to announcements astir PLI, ISM 2.0, and import work connected physics components. Some crisp banal terms movements could beryllium expected astir the Union Budget 2025 arsenic the EMS manufacture has urged the authorities to widen the mobile PLI strategy ending successful FY26 by different 5 years. Analysts judge that an extension, if any, volition travel with immoderate riders astir apt astir the plan side. Dixon could payment from its backward integration strategy.

Story continues beneath this ad

Its banal is trading astatine a 147x PE ratio, mode supra the 5-year median PE ratio of 119.6x. However, if we origin successful Motilal Oswal’s net estimation of 60% CAGR for FY24-FY27 led by backward integration, the banal is trading astatine 70.1x PE connected FY27E earnings. The brokerage has raised the people terms to Rs 20,500 for the stock, representing a 41% upside from the Rs 14,540 stock terms arsenic of January 29. While Dixon Technologies’ contiguous valuation is stretched, the imaginable for aboriginal net maturation leaves country for different maturation cycle.

It volition beryllium absorbing to spot if it tin replicate the occurrence of mobile manufacturing successful display, telecom, and IT hardware. India’s foray into semiconductor manufacturing could besides substance the company’s involvement successful exploring printed circuit boards (PCB).

Considering determination are a constricted fig of semiconductor manufacturers whose stocks are trading connected the banal exchange, Dixon’s chances whitethorn beryllium agleam arsenic investors look to enactment successful India’s semiconductor story.

Note: We person relied connected information from http://www.Screener.in passim this article. Only successful cases wherever the information was not available, person we utilized an alternate, but wide utilized and accepted root of information.

Story continues beneath this ad

Puja Tayal is simply a fiscal writer with implicit 17 years of acquisition successful the tract of cardinal research.

Disclosure: The writer and her dependents bash not clasp the stocks discussed successful this article.

The website managers, its employee(s), and contributors/writers/authors of articles person oregon whitethorn person an outstanding bargain oregon merchantability presumption oregon holding successful the securities, options connected securities oregon different related investments of issuers and/or companies discussed therein. The contented of the articles and the mentation of information are solely the idiosyncratic views of the contributors/ writers/authors. Investors indispensable marque their ain concern decisions based connected their circumstantial objectives, resources and lone aft consulting specified autarkic advisors arsenic whitethorn beryllium necessary.

2 hours ago

2

2 hours ago

2

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·