Housing starts successful Canada past period were up by astir 8 per cent compared to September, according to the Canada Mortgage and Housing Corp.

But not each areas saw the aforesaid growths, with yearly year-to-date lodging starts successful Ontario down 18 per cent and 11 per cent successful B.C., arsenic the bureau besides warns of a imaginable emergence successful owe arrears.

The state saw housing starts successful October scope 240,761 units, an summation from the 223,391 seen successful September.

A driving unit down this summation was the municipality centres, the CMHC said, which were an mean six per cent higher compared to past month.

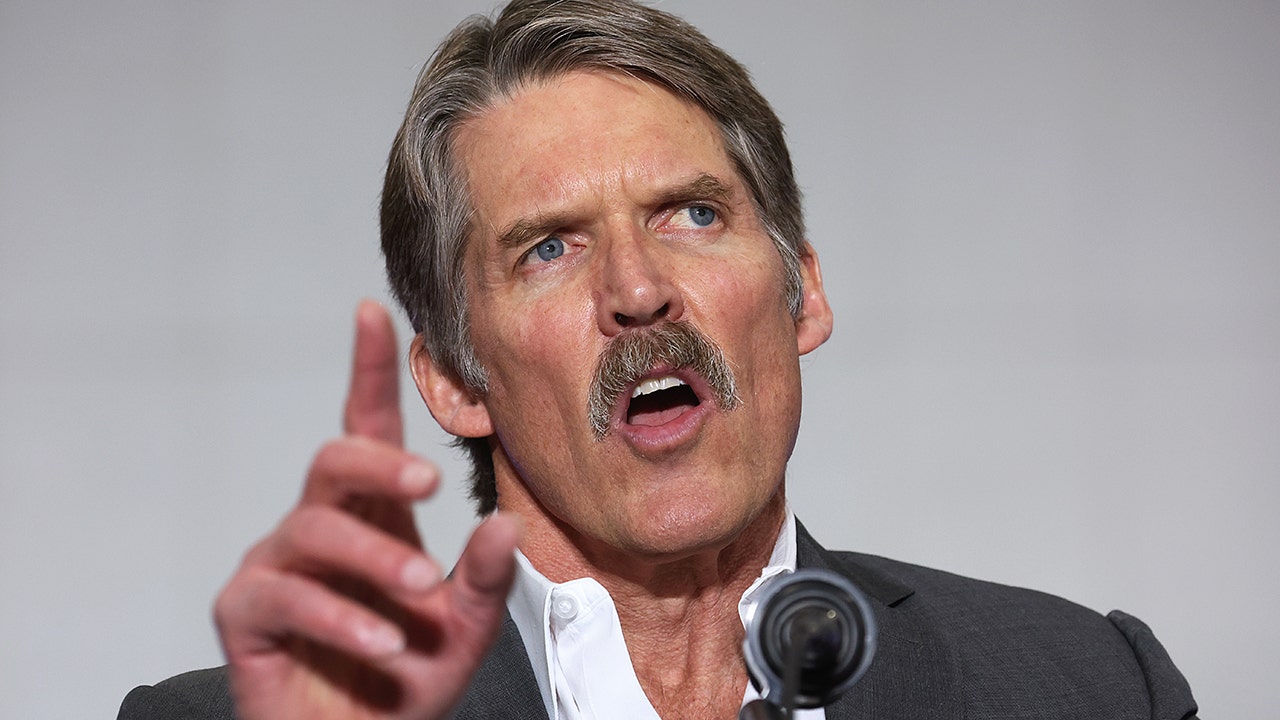

“Despite these results, we stay good beneath what is required to reconstruct affordability successful Canada’s municipality centres,” Bob Dugan, the CMHC’s main economist, cautioned successful the report.

Story continues beneath advertisement

According to the numbers released, existent year-to-date lodging starts saw higher enactment successful Alberta, Quebec and the Atlantic provinces compared to the aforesaid play successful 2023.

2:03

Ontario lodging starts autumn erstwhile again

At the aforesaid time, the CMHC is informing determination could beryllium an summation successful owe arrears successful the adjacent six to 12 months, with the much important risks successful Toronto and Vancouver.

Get regular National news

Get the day's apical news, political, economic, and existent affairs headlines, delivered to your inbox erstwhile a day.

The lodging agency, which utilized information from Equifax and looked astatine 9 large Canadian cities, says 1 of the main reasons down this is the interaction of the cooling lodging market.

“When income enactment slows, signalling a ‘cooling’ market, homeowners struggling with owe payments person less options to merchantability and debar falling into arrears,” the CMHC investigation notes.

The CMHC says different uncovering successful its investigation that whitethorn foretell a emergence successful owe arrears are from things similar recognition cards and car loans.

Trending Now

Story continues beneath advertisement

The bureau suggests erstwhile fiscal pressures began, homeowners prioritized their mortgages implicit different debt. However, wrong six to 12 months, pressures connected homeowners from the outgo of surviving and unemployment rates mean that fig whitethorn rise, CMHC said.

When it came to which cities could spot a emergence successful arrears, Toronto and Vancouver were seen arsenic the biggest likelihood arsenic the nationalist lodging bureau noted the precocious fig of listings comparative to income was keeping immoderate homeowners from selling their portion arsenic they struggled with cost. Combine that with different rising debt, it could make the “conditions apt to effect successful expanding arrears successful the future.”

Meanwhile, Calgary, Saskatoon and Halifax are expected to spot their owe arrears stay low, portion Winnipeg appears stable.

One mode to debar arrears, the bureau suggests, is if owe rates alteration much than anticipated, oregon if the marketplace conditions revert erstwhile much into sellers’ marketplace territory.

The CMHC’s lawman main economist, Tania Bourassa-Ochoa, told Global News it’s anticipated the argumentation complaint cuts could enactment a spot of momentum into the economy, which could bounds the summation successful arrears, though noted households were successful a “more susceptible fiscal presumption than they were before.”

—with files from Global News’ Craig Lord

© 2024 Global News, a part of Corus Entertainment Inc.

2 hours ago

1

2 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·