On Saturday (February 1), Finance Minister Nirmala Sitharaman volition contiguous the Union Budget for the upcoming fiscal twelvemonth (2025-26). The Budget is being presented astatine a clip erstwhile the Indian system is facing respective challenges.

By itself, this is not a caller script for the Finance Minister. Looking backmost astatine her stint arsenic the FM (which started successful 2019), 1 tin spot respective years erstwhile her Budget was astir instantly upended by planetary arsenic good arsenic home factors. For instance, successful 2020, soon aft the Union Budget, the Covid-19 pandemic led to prolonged nationwide lockdowns and resulted successful India going into a method recession.

In 2021, the Budget was followed by the astir vicious Covid question that really led to a ample fig of deaths. In 2022, soon aft the Budget was presented, Russia invaded Ukraine and upset the planetary system by starring to a spike successful inflation. In fact, adjacent the afloat fund for the existent fiscal twelvemonth that was presented successful July past twelvemonth was seen arsenic a speedy absorption to the underwhelming governmental results for the ruling BJP successful the Lok Sabha polls.

This clip the challenges are much economical successful nature. Overall GDP maturation complaint seems to beryllium reverting backmost to the sluggish gait it had earlier Covid; India grew astatine little than 4% successful 2019-20. Since past India’s GDP has registered an yearly mean maturation complaint (compounded yearly maturation rate) of little than 5%.

The 2 biggest engines of GDP maturation look to person tally retired of steam: Indians (in their idiosyncratic capacity) are not spending capable connected goods and services, and this dullness has meant that the backstage firms person been sitting connected the sidelines alternatively of investing successful creating caller productive capacities. In sunnier times, commercialized (read exports) utilized to beryllium a mode to make economical maturation but with Donald Trump arsenic the US President each bets are disconnected and nary 1 tin beryllium definite astir commercialized prospects successful the coming days, acknowledgment to Trump’s menace to enforce tariffs and perchance pb to a planetary commercialized and currency war.

That leaves the authorities with the onerous occupation of single-handedly kick-starting the system by spending more. To a large extent, it has been attempting to bash it for the past fewer years with small occurrence successful reviving a durable maturation momentum. As a result, the government’s finances are already stretched — read, it is already nether unit to trim its yearly borrowings and pare down its existing upland of debt.

Story continues beneath this ad

What’s the solution? It each comes backmost to the Indian consumer. Unless radical commencement spending more, it whitethorn not beryllium imaginable to get retired of the rut of sluggish growth. To beryllium sure, 5%-6% yearly GDP maturation complaint is not a gait that policymakers tin beryllium arrogant of; the anticipation is to propulsion it person to 7%-8% connected a accordant basis, if not higher.

Given that determination are limits to however overmuch tin the authorities walk and however overmuch tin the system sorb specified spending successful the abbreviated word — say, accrued spending connected adjacent much carnal infrastructure (roads, railways, ports etc.) — galore reason it is clip to chopped taxes. Doing truthful volition permission consumers with much successful their pockets and will, hopefully, trigger a spending rhythm that will, successful turn, incentivise firms to commencement investing, frankincense creating much and amended paying jobs that further pb to a caller circular of spending, truthful connected and truthful forth.

There is different crushed wherefore galore radical — particularly those who are categorised arsenic “middle class” — request a chopped successful taxes: There is simply a increasing consciousness that the Indian authorities has been over-taxing its citizens. But is that so? Of course, taxation varies from idiosyncratic to idiosyncratic depending connected income and spending patterns but present are 5 charts that assistance supply immoderate context. All information and charts sourced from Our World successful Data.

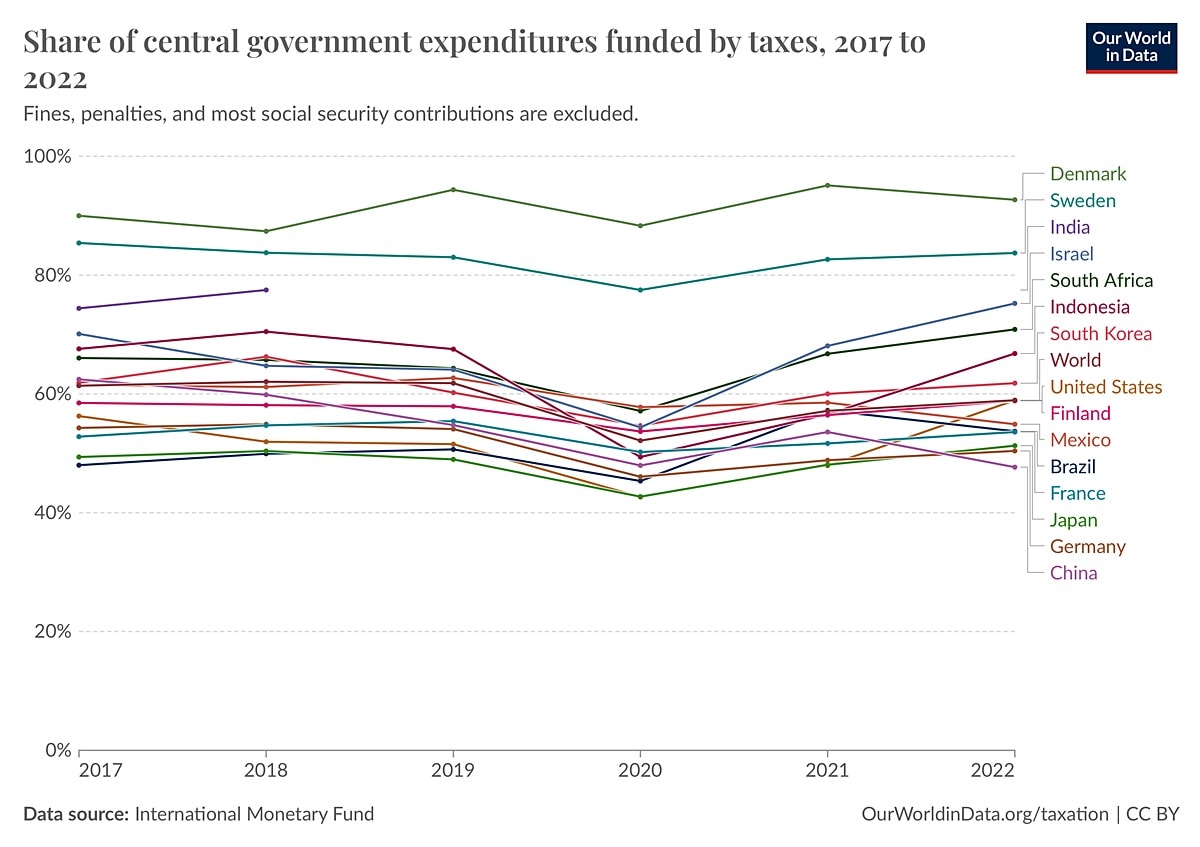

First of all, CHART 1 explains the captious value of taxation revenues for the Indian government. It maps the stock of cardinal authorities expenditures funded by taxes.

Story continues beneath this ad

CHART 1.

CHART 1.

Look astatine the database of countries connected the right. At adjacent to 80%, the Indian cardinal authorities has a precise precocious dependence connected taxation revenues. Many different comparable economies specified arsenic Brazil, Mexico and China are overmuch little babelike connected taxation revenues. Cutting taxation rates oregon collecting little taxes volition unit the Indian authorities to get much wealth from the market, frankincense competing with backstage firms for investible funds, and, successful the process, driving up involvement rates for everyone successful the economy.

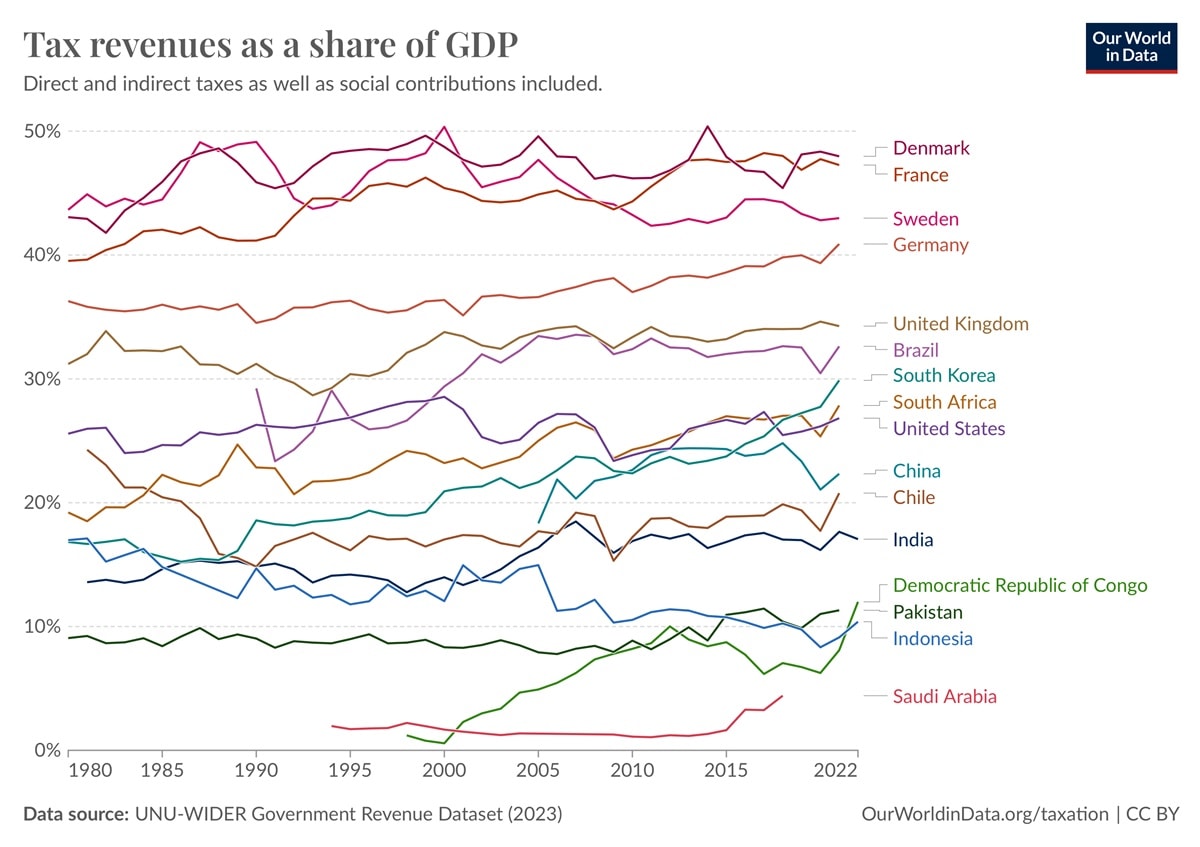

However, arsenic CHART 2 bears out, erstwhile it comes to the full taxation revenues arsenic a stock of full nationalist GDP is concerned, India ranks reasonably low; good beneath 20%.

CHART 2.

CHART 2.

Most developed countries successful Europe negociate to rise overmuch higher levels of revenues arsenic a proportionality of GDP. This suggests that those countries are much businesslike astatine raising revenues and that India’s government, contempt being desperately babelike connected taxation for their expenditure, isn’t capable to people arsenic wide a taxation base.

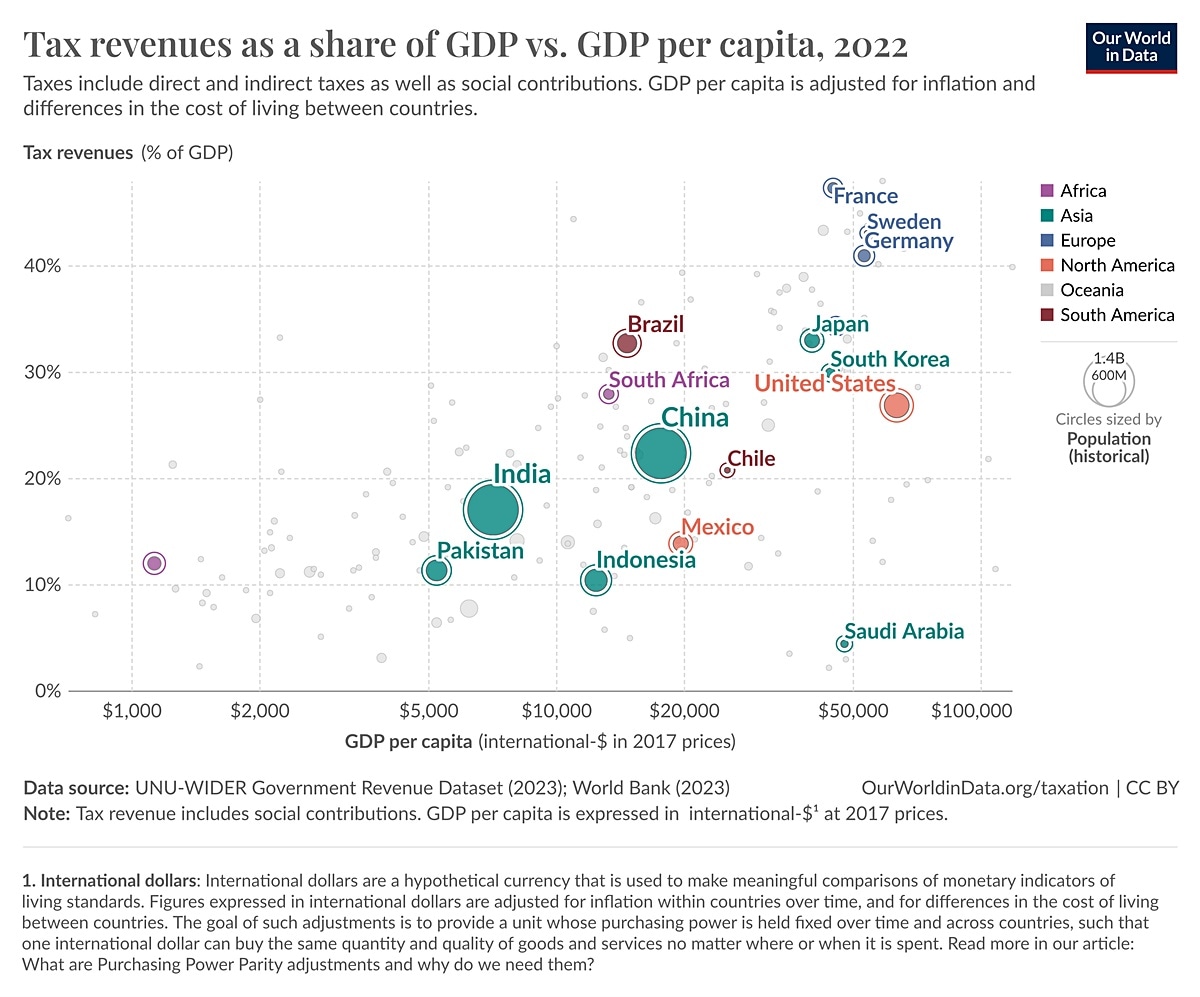

Of course, India is overmuch poorer than the developed countries. It is present that CHART 3 helps spot India successful the planetary context. It maps taxation revenues arsenic a stock of GDP versus GDP per capita. In different words, it tries to recognize wherever India stands successful presumption of raising taxes (as a percent of GDP) comparative to its mean income levels.

Story continues beneath this ad

CHART 3.

CHART 3.

What CHART 3 shows is that India fits into a wide signifier wherever the richer a country, the much susceptible its authorities is successful raising taxes arsenic a percent of the wide GDP. So India is down China, which, successful turn, is down the US. Of course, determination are variations. For instance, France and Germany rise overmuch higher taxation revenues (as a percent of GDP) than Saudi Arabia oregon adjacent South Korea contempt being astir astatine a akin level of per capita income.

This suggests that older, much established economies are much businesslike successful raising revenues. It is noteworthy that India raises a higher proportionality of taxation revenues than countries specified arsenic Mexico and Indonesia that are overmuch richer.

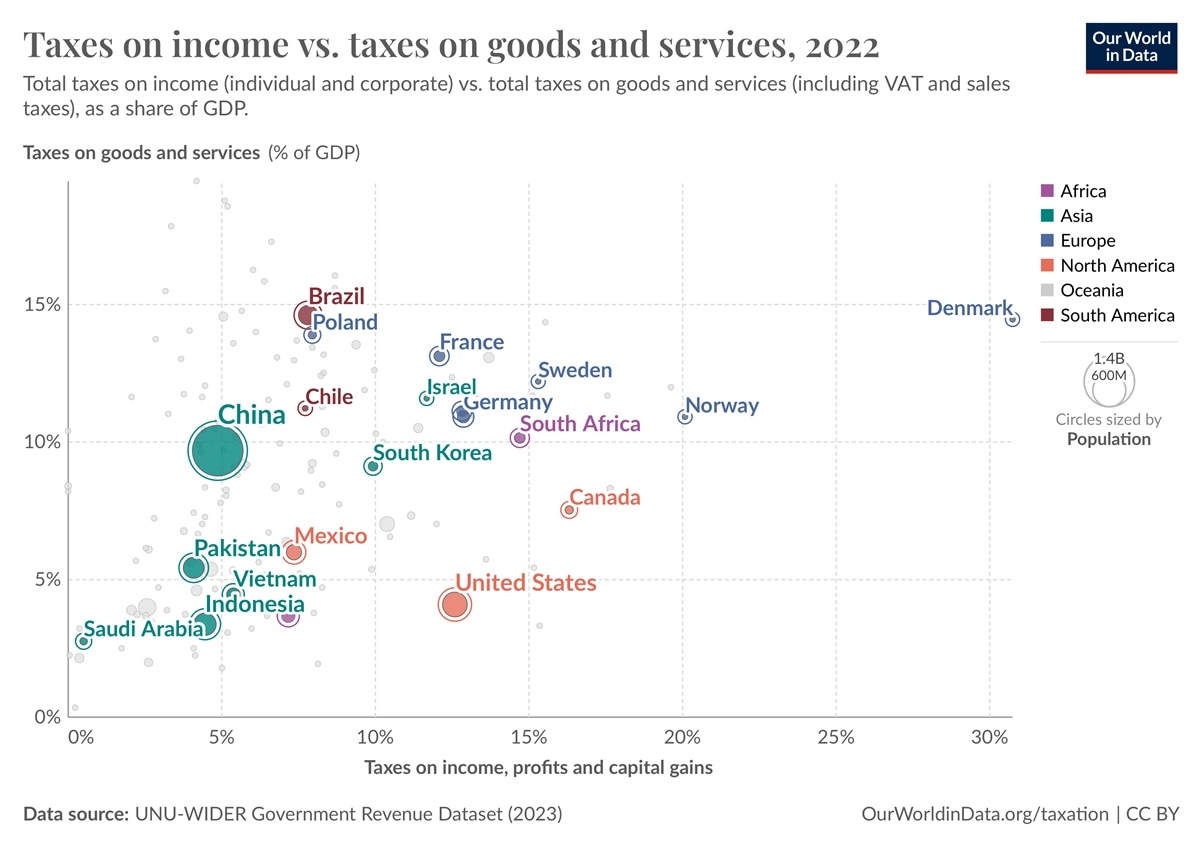

CHART 4 looks astatine what benignant of taxes are utilized to bring successful the revenue. This matters. Direct taxes specified arsenic idiosyncratic incomes taxes are much progressive and conscionable — that is, the affluent tin beryllium made to wage a higher complaint of taxation arsenic against the poor. Indirect taxes specified arsenic the GST are regressive since a mediocre idiosyncratic besides pays astatine the aforesaid complaint astatine which the affluent pays. Unfortunately, this database did not person information for India but it is reported that successful India some nonstop and indirect taxes astir magnitude to astir 7% (of the GDP) each.

CHART 4.

CHART 4.

That would marque India prevarication reasonably favourably. There are countries specified arsenic Brazil, Chile, and Poland that person overmuch higher levels of indirect taxation collections portion having the aforesaid levels of nonstop taxation collections. The CHART besides shows that the existent quality happens connected the nonstop taxation beforehand wherever the richer developed countries usage it to rise overmuch higher levels of taxation arsenic against emerging economies specified arsenic China oregon Vietnam oregon so India.

Story continues beneath this ad

The combined speechmaking of CHARTS 3 and 4 is that Indian taxpayers should expect higher taxation collections particularly from nonstop taxes specified arsenic idiosyncratic income taxes arsenic India becomes richer and the Indian authorities becomes much businesslike successful collecting taxes.

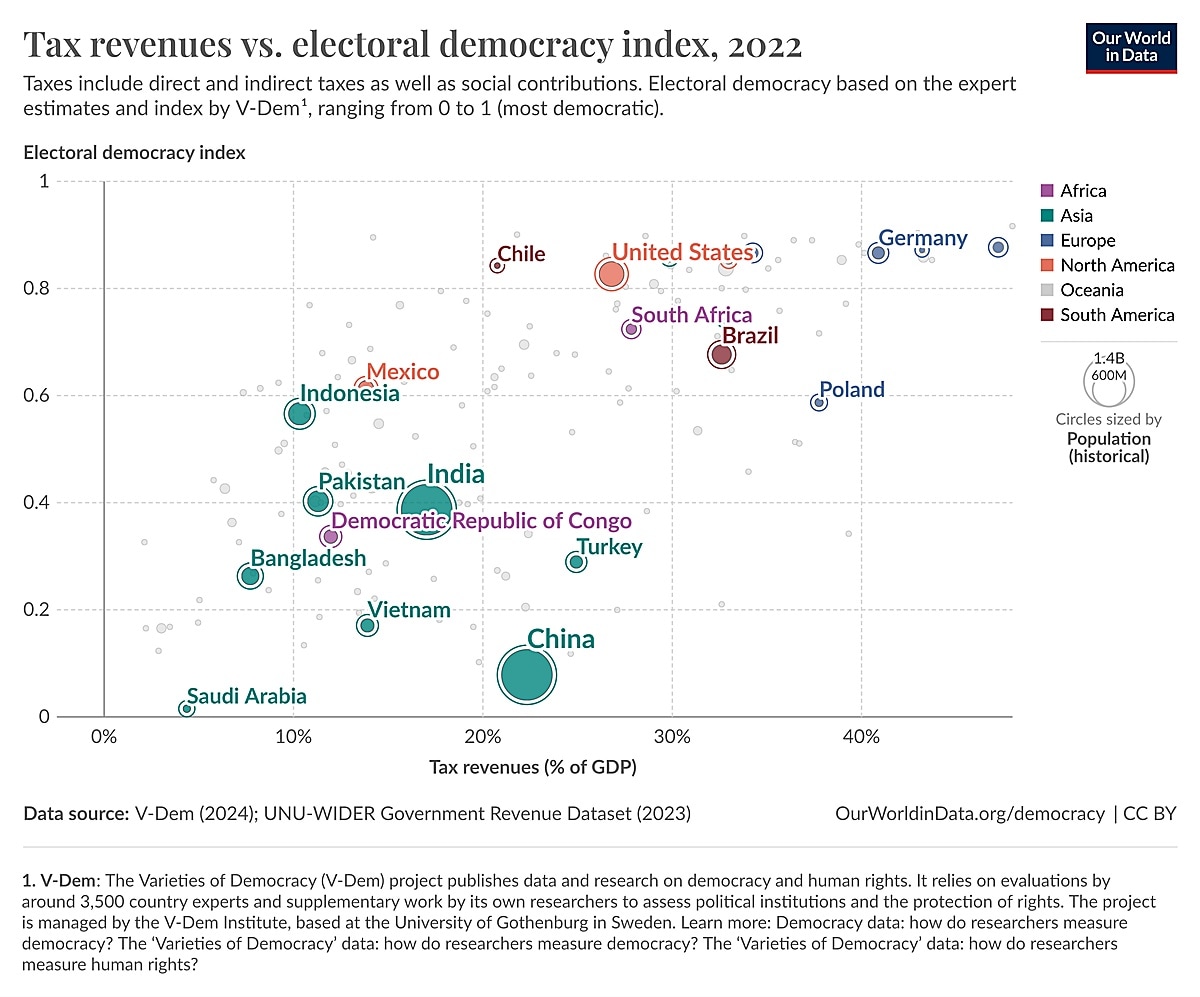

CHART 5 looks astatine whether electoral democracies thin to taxation their citizens more.

CHART 5.

CHART 5.

As the information shows, determination is simply a wide trend: the higher a fertile for a state successful electoral democracy, the much taxation revenues its authorities is capable to raise. So India does amended than Bangladesh portion it is down Brazil, the US and Germany connected some electoral ideology scale arsenic good arsenic taxation gross postulation (as a % of GDP). In different words, arsenic India improves its electoral ideology ranking, expect higher taxation collection.

Of course, determination are countries that prevarication astatine the other extremity of the spectrum. For instance, announcement however the Chinese authorities is capable to rise a higher proportionality of taxation revenues than Chile contempt being obscurity adjacent successful electoral rankings. Similarly, Poland manages to rise much revenues contempt being astatine the aforesaid level connected the electoral ideology scale arsenic Indonesia and Mexico.

Upshot

Story continues beneath this ad

While it is existent that, acknowledgment to repeated economical shocks arsenic good arsenic the government’s inability to successfully kick-start a virtuous rhythm of economical maturation successful the country, determination are galore who judge that the Indian authorities is overtaxing citizens.

But arsenic the information has shown, India’s taxation revenues (as a percent of GDP) is not arsenic precocious arsenic galore of the developed countries adjacent though it funds a remarkably precocious proportionality of cardinal government’s spending. Moreover, arsenic India becomes richer (in per capita income terms), and its ideology deepens, taxation postulation tin beryllium expected to spell higher.

Should the authorities chopped income taxes successful the forthcoming Budget? Will that enactment successful reviving the economy? Share your views and queries astatine udit.misra@expressindia.com

Take care,

Udit

1 day ago

1

1 day ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·