A surge successful farmers scrambling for fiscal and ineligible counsel has been reported since the changes to inheritance tax.

Concerns are mounting among the cultivation assemblage that younger generations mightiness beryllium pushed to merchantability disconnected onshore oregon buildings to settee taxation dues, perchance fragmenting farms passed down done generations. Advisors besides accidental that younger generations could inherit assets sooner—during their parents' lives—as families program for the taxation adjustments.

Thousands of farmers marched connected Westminster connected Tuesday, protesting the Budget's inheritance taxation changes that endanger to bounds 100% alleviation connected farms to the archetypal £1m of cultivation and concern property.

Wealth absorption radical Evelyn Partners said it has seen an uptick successful inquiries from farmers seeking proposal aft the changes were announced.

Director Jason Hollands said: "Changes successful the Budget arsenic to however definite assets are treated for inheritance taxation person been a large root of interest for some existing and imaginable clients, particularly successful narration to the attraction of pensions, but besides for concern owners and farmers, too, owed to the capping of reliefs."

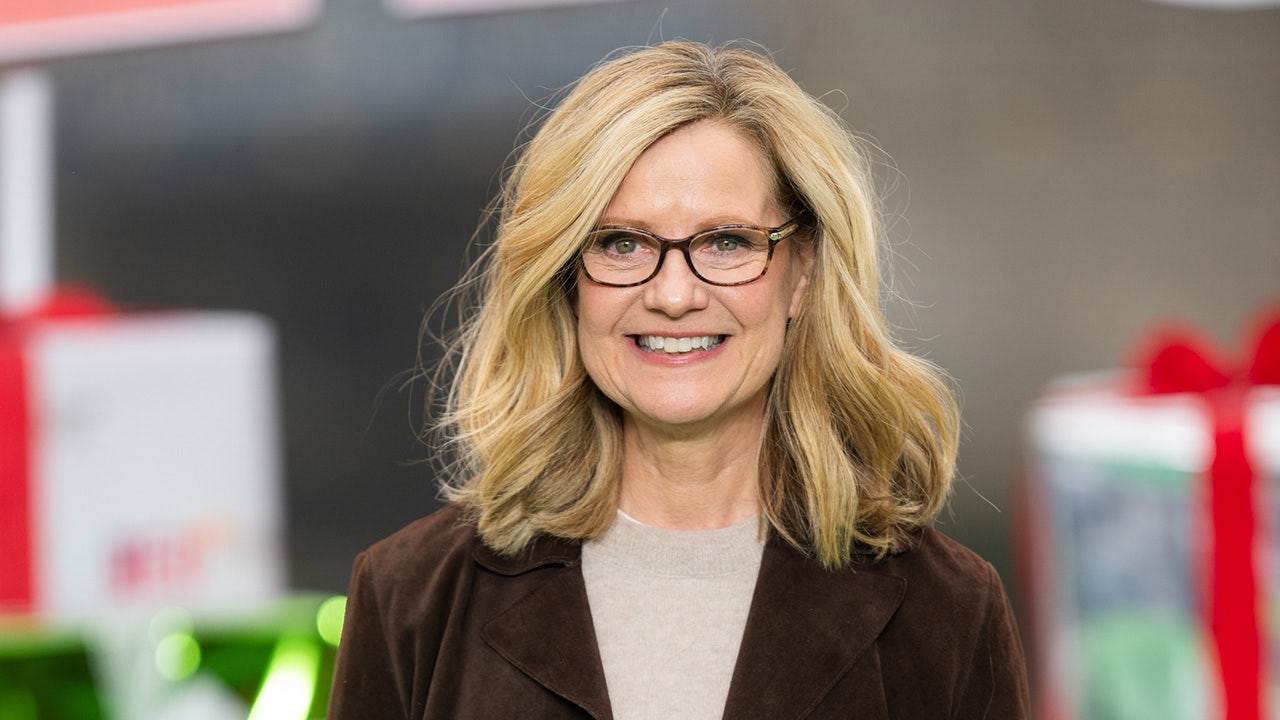

“The measures announced by Rachel Reeves person upended galore people’s fiscal plans and truthful since the Budget we person been precise engaged helping radical recognize the implications of these measures and research their options.

“Restrictions connected cultivation spot alleviation are peculiarly challenging for family-owned farms, arsenic portion the worth of the assets successful presumption of onshore and instrumentality are superficially high, income from farming is not, leaving their families with the imaginable of gathering precise precocious taxation bills erstwhile they dice with constricted resources to conscionable the costs different than by selling disconnected onshore and breaking up farms that, successful galore cases, person been successful the aforesaid families for generations.”

Sean McCann, chartered fiscal planner astatine insurer NFU Mutual, said: “Agricultural spot alleviation is successful spot to support British agriculture and guarantee household farms are not breached up erstwhile they’re passed on.

“It enables farmers to put successful their semipermanent aboriginal with the cognition their household workplace is sustainable for the adjacent generation.

“We’ve seen a increasing fig of farmers wanting to cognize however the projected changes volition impact them and their families.

“Many are acrophobic their successors whitethorn request to merchantability onshore oregon buildings to wage an inheritance taxation measure starring to smaller, little businesslike farms arsenic a result.”

Iwan Williams, a spouse astatine Michelmores LLP, which has offices successful London, Bristol, Exeter and Cheltenham, said: “These are undoubtedly highly worrying times for farmers and determination is simply a beardown feeling wrong the agrarian assemblage that the taxation changes simply bash not bespeak the world of what is required to prolong a viable farming business.

“Faced with impending change, advisers person been considering what comes next, and however to program ahead.

“There are options. Valuable property readying tools stay – the quality to acquisition assets successful the anticipation of surviving 7 years, structuring assets efficiently to maximise reliefs, and beingness assurance, to sanction a few.

“Farming families are going to person to cautiously see however and erstwhile to walk assets to the adjacent procreation – not easy, and determination is simply a hard equilibrium to beryllium struck betwixt taxation ratio and retaining capable power and comfortableness successful retirement.”

He added: “Succession is often a delicate taxable for families mostly – conversations are enactment successful the ‘too difficult’ heap – but the timing of robust concern succession readying has ne'er been much important.

“We are helping to usher families done their options for mitigating this caller challenge, to assistance guarantee that viable farming businesses tin inactive beryllium transferred efficiently successful the close circumstances.”

Ingrid McCleave, a spouse astatine DMH Stallard, which has offices successful London, Brighton, Gatwick, Guildford, Hassocks and Horsham, said: “I person had clients starting to publication meetings to sermon the changes to cultivation spot relief.

“Whereas, readying was chiefly via wills oregon beingness trusts, it is going to precise overmuch present beryllium beingness planning, beingness gifting and usage of household concern companies wherever the worth of the parents’ shareholding is frozen and aboriginal maturation is held wrong the children’s shareholding, thereby mitigating the parents’ vulnerability to inheritance tax.

“Parents tin determine however overmuch power to springiness their children with bespoke shares.

“Inevitably, children are going to person farming assets sooner, during their parents’ lifetime.”

Hayden Bailey, caput of backstage lawsuit and taxation astatine Boodle Hatfield, which has offices successful London and Oxford, said: “The reforms marque nary favoritism betwixt a moving husbandman and the viability of their farming operations connected the onshore and a agelong word capitalist successful onshore arsenic an plus class.”

He added: “Older landowners who person historically been advised to clasp onto onshore until decease whitethorn not person capable years near to marque plans to transportation ownership to the adjacent generation...

“We expect to spot landowners approaching the steadfast for assistance and proposal pursuing the announcement, but wherever nett margins are often precise choky and the older procreation trust upon taking an income, the succession readying opportunities tin beryllium limited, which could pb to sales.”

Karen Perugini, a spouse successful the succession and taxation squad astatine Thrings, based successful Romsey, Hampshire, said: “We person surely seen an summation successful inquiries from our farming clients since the Budget announcement, with galore intelligibly tense astir however the alteration to the cultivation spot alleviation is going to interaction the aboriginal of their businesses successful the hands of the adjacent generation.

“The biggest question we person been getting is simply what it means for their business, but for galore their queries are astir succession readying and however they tin restructure their concern and their property to maximise the remaining benefits of the relief.”

.png) 4 days ago

1

4 days ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·