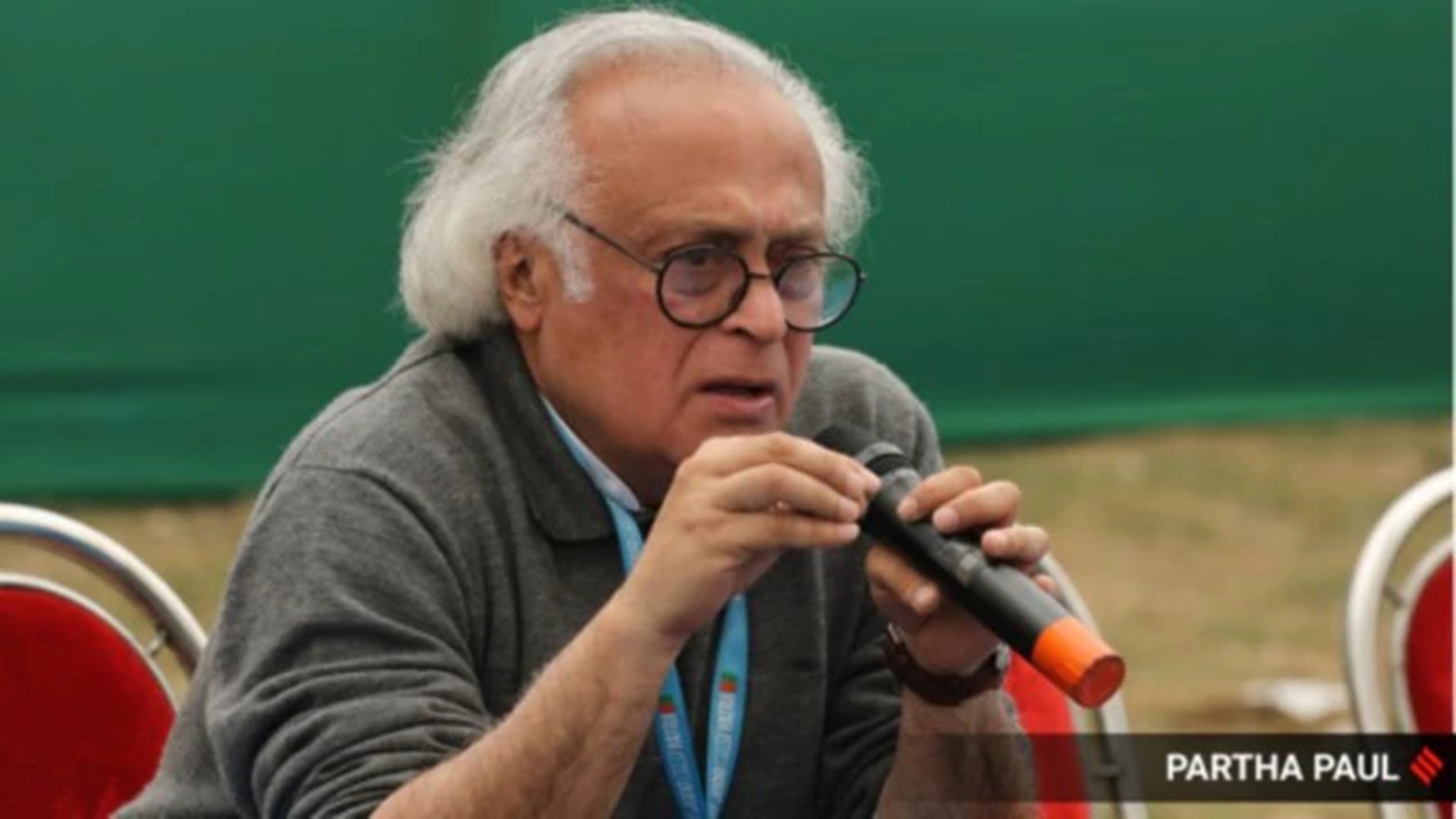

India should see outsourcing tribunal absorption for insolvency proceedings to backstage players to chopped delays and boost creditor recovery, erstwhile NITI Aayog CEO and G20 Sherpa Amitabh Kant said Monday. Speaking astatine the Insolvency and Bankruptcy Board of India’s (IBBI) yearly meeting, Kant called for a 2nd procreation of reforms to fortify the Insolvency and Bankruptcy Code (IBC), 2016. He added that the authorities is considering amendments to the IBC aft a broad reappraisal was undertaken past year.

In summation to bringing successful backstage players to “minimise judicial bandwidth connected administrative matters,” Kant said projected amendments to the IBC could besides clarify cardinal ineligible principles and alteration the implementation of a cross-border insolvency framework.

“We indispensable admit immoderate concerns regarding the contiguous functioning of the IBC, indicating a request for a 2nd procreation of reforms. Analysis of IBBI’s ain information shows that insolvency resolutions astatine the National Company Law Tribunal (NCLT) averaged 716 days successful FY24, up from 654 days successful FY23. More concerning is the mean clip taken for the admittance of cases, which stood astatine 468 days successful FY21 and accrued to 650 days successful FY22,” Kant said.

He noted determination is an inverse narration betwixt the clip taken for solution and the worth recovered, highlighting that delays are eroding creditor recoveries. He added the complaint of betterment for creditors arsenic a percent of admitted claims fell to 27 per cent successful FY24 from 36 per cent successful FY23. As a solution, Kant projected outsourcing tribunal absorption to backstage players, similar successful the lawsuit of Passport Seva Kendras that are operated by Tata Consultancy Services Ltd.

“It is often said that justness delayed is justness denied. We request a breakthrough thought to hole this and determination is simply a request for tribunal process re-engineering. It is indispensable to minimise judicial bandwidth connected administrative matters portion opening non-court functions to innovative non-sovereign oregon backstage players to deploy exertion for improved tribunal management,” helium said.

“For example, the privatisation of Passport Seva Kendras has resulted successful a seamless process and akin models could enactment for tribunal processes… With investments successful backstage superior and future-ready innovation, judicial process re-engineering could heighten the medication of justness successful India,” Kant added.

He besides said that caller NCLT rulings nether the IBC “have deviated from the established position”, particularly with respect to the supremacy of the commercialized contented of the Committee of Creditors (CoC), the established waterfall of dues with the state’s dues being subordinated, and the request of NCLT to admit a petition erstwhile a fiscal indebtedness exists without exercising immoderate measurement of discretion. He said projected amendments should enactment towards “clarifying ambiguity connected cardinal ineligible principles”.

Kant besides stressed the request for implementing a cross-border insolvency model arsenic Indian companies participate planetary worth chains.

“Sections 234 and 235 of the IBC supply lone an enabling model for cross-border insolvency, which is yet to beryllium acted upon… There person been innovations similar the protocol for practice established successful the Jet Airways case, but with India becoming an integral portion of planetary worth chains, we volition yet request a exemplary instrumentality connected cross-border insolvency,” helium said.

Kant added that the authorities is already considering an amendment to the IBC wherein the Record of Default (RoD) certificate issued by the National E-Governance Services Ltd (NeSL) would beryllium capable to substantiate default without immoderate further deliberation.

“I recognize that a broad reappraisal of the IBC was undertaken past twelvemonth and amendments are nether information of the government. These amendments are expected to trim delays and summation the betterment of creditors,” helium said.

At IBBI’s 8th yearly day, chairperson Ravi Mital besides addressed the contented of delays and important haircuts faced by creditors. “We did a survey successful our bureau and recovered that erstwhile cases are admitted into IBC, they person already mislaid much than 50 per cent of their value. Now, IBC is not liable if the creditors bring the cases late. IBC is liable erstwhile a lawsuit is brought earlier IBC, and if you look astatine betterment arsenic a percent of just value, we retrieve 84 per cent,” helium said.

Mital besides said clip is taken nether the IBC due to the fact that it is simply a creditor-led exemplary arsenic opposed to a debtor–led model, due to the fact that of which “the debtor tries his champion to guarantee that the lawsuit is not admitted”.

As of June 30, 7,813 firm insolvency proceedings were admitted nether the IBC, of which 2,547 cases (33 per cent) ended successful liquidation, 1,005 cases (13 per cent) were resolved, 1973 cases (25 per cent) are ongoing, and the remaining were either withdrawn oregon closed.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·