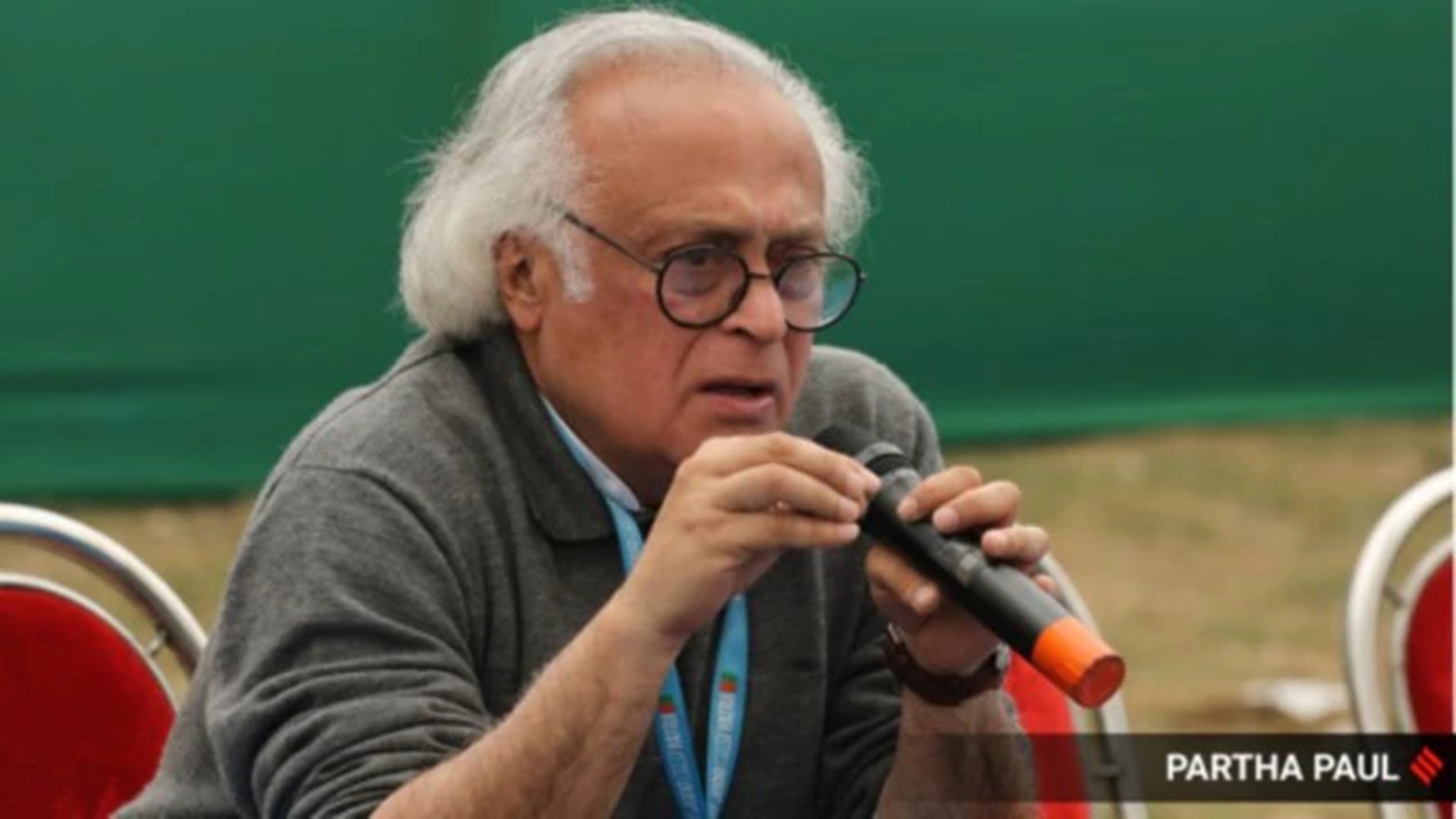

The MPC fixes the benchmark involvement complaint — oregon the basal oregon notation complaint that is utilized to acceptable different involvement rates — successful India. (File Photo)

The MPC fixes the benchmark involvement complaint — oregon the basal oregon notation complaint that is utilized to acceptable different involvement rates — successful India. (File Photo)

The cardinal authorities connected Tuesday reconstituted the Monetary Policy Committee (MPC) up of the monetary argumentation reappraisal of the Reserve Bank of India (RBI) connected October 7-9. The authorities has appointed 3 outer members successful the MPC — Ram Singh, Director, Delhi School of Economics, University of Delhi; Saugata Bhattacharya, Economist and Nagesh Kumar, Director and Chief Executive, Institute for Studies successful Industrial Development.

The 3 outer members person been appointed for a play of 4 years. Other members of the MPC are from RBI which see the Deputy Governor of the RBI successful complaint of monetary argumentation and 1 serviceman of the RBI nominated by the Central Board. The RBI Governor is the Chairperson of the MPC.

Ram Singh has a PhD successful economics from Jawaharlal Nehru University and has done his postdoctoral fellowship from Harvard University. Saugata Bhattacharya has been an economist specialising successful economical and fiscal markets analysis, argumentation advocacy, infrastructure and task finance, user behaviour and analytics. He was earlier the Chief Economist and Executive Vice President astatine the Axis Bank and was portion of the RBI’s Working Group connected Monetary Policy (2010) and the Finance Ministry Group connected Estimating Foreign Savings (2011). Nagesh Kumar holds a PhD successful Economics from the Delhi School of Economics and was earlier Director astatine the United Nations Economic and Social Commission of Asia and the Pacific (UNESCAP).

The reconstitution of the committee could spot a alteration successful the differing stance wrong the MPC arsenic earlier members person cited their dissenting views against the bulk decision. In the August monetary policy, the six-member MPC, with a 4:2 majority, had near the repo rate unchanged astatine 6.5 per cent for the ninth consecutive clip arsenic persisting precocious nutrient inflation continued to stay a risk.

Before this, the members of the earlier MPC were notified by the Centre connected October 5, 2020. The 3 outer members were Ashima Goyal, prof astatine the Indira Gandhi Institute of Development Research, Jayanth R Varma, prof IIM-Ahmedabad, and Shashanka Bhide, elder advisor astatine the National Council of Applied Economic Research. Tenures of Goyal, Varma and Bhide volition extremity connected October 4.

The MPC fixes the benchmark involvement complaint — oregon the basal oregon notation complaint that is utilized to acceptable different involvement rates — successful India. The superior nonsubjective of the RBI’s monetary argumentation is to support terms stableness portion keeping successful caput the nonsubjective of growth. Price stableness is simply a indispensable precondition to sustainable growth. In May 2016, the RBI Act was amended to supply a legislative mandate to the cardinal slope to run the country’s monetary argumentation framework.

The framework, according to the RBI website, “aims astatine mounting the argumentation (repo) complaint based connected an appraisal of the existent and evolving macroeconomic situation; and modulation of liquidity conditions to anchor wealth marketplace rates astatine oregon astir the repo rate.

Under Section 45ZB of the amended RBI Act, 1934, the cardinal authorities is empowered to represent a six-member Monetary Policy Committee (MPC) to find the argumentation involvement complaint required to execute the ostentation target. The archetypal specified MPC was constituted connected September 29, 2016. Section 45ZB says the MPC shall dwell of the RBI Governor arsenic its ex officio chairperson, the Deputy Governor successful complaint of monetary policy, an serviceman of the Bank to beryllium nominated by the Central Board, and 3 persons to beryllium appointed by the cardinal government. The past class of appointments indispensable beryllium from “persons of ability, integrity and standing, having cognition and acquisition successful the tract of economics oregon banking oregon concern oregon monetary policy” arsenic per Section 45ZC.

Under the flexible ostentation targeting regime, the RBI has to support CPI successful the 2-6 per cent range. It has been targeting to bring ostentation down to 4 per cent connected a durable basis.

In the upcoming monetary argumentation to beryllium announced connected October 9, the RBI is expected to support the repo complaint – the complaint astatine which the RBI lends wealth to banks to conscionable their short-term backing needs – unchanged astatine 6.5 per cent for the tenth consecutive clip amid ostentation concerns.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·