Once the caller taxation slabs are in, you tin usage Indian Express's income taxation calculator to cipher your taxation for fiscal twelvemonth 2025-26.

Once the caller taxation slabs are in, you tin usage Indian Express's income taxation calculator to cipher your taxation for fiscal twelvemonth 2025-26.

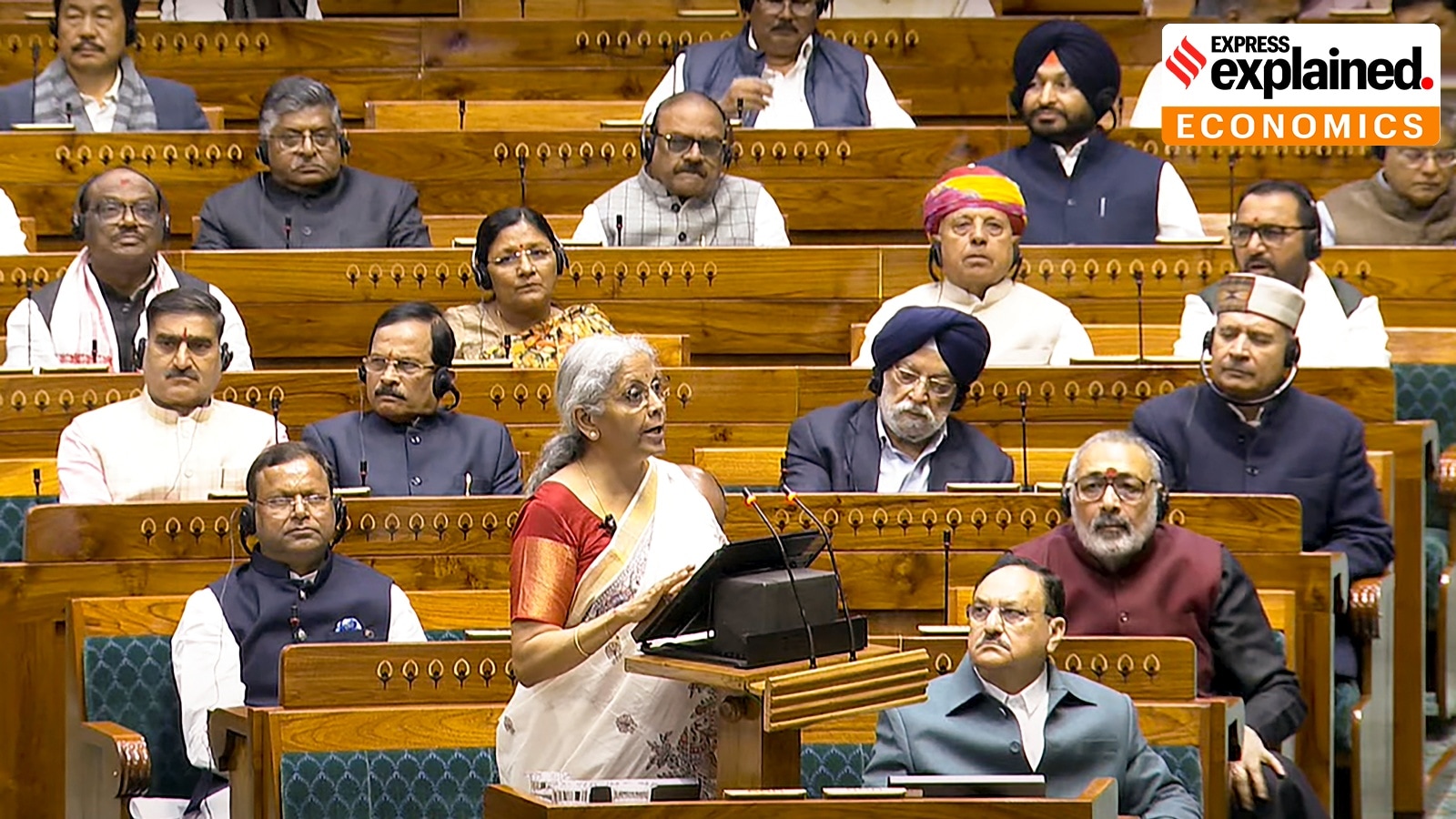

Income Tax Calculator: As Union Finance Minister Nirmala Sitharaman gears up to contiguous her eighth fund nether Prime Minister Narendra Modi-led NDA authorities today, determination are rising expectations regarding immoderate signifier of alleviation for the taxpayers, particularly the vocal “middle class”. People are looking guardant to the fund anticipating important changes successful the taxation slabs nether the caller taxation authorities arsenic good arsenic a hike successful modular deductions and Section 87A rebates.

In the Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman soon aft the NDA was backmost successful the authorities for the 3rd consecutive word nether Modi, the caller taxation authorities got amended for the mediate people with the summation successful modular deduction to Rs 75,000 from Rs 50,000. The taxation slabs were besides tweaked with those falling successful Rs 3-7 lakh income bracket requiring to wage 5 per cent arsenic taxation portion those falling successful Rs 7-10 lakh and Rs 10-12 lakh to wage 10 and 15 per cent of their income arsenic taxation respectively.

But, however to cipher your income taxation online?

Once the caller taxation slabs are in, you tin usage Indian Express’s income taxation calculator to cipher your taxation for fiscal twelvemonth 2025-26.

Income Tax Calculator for FY 2025-26: Steps to check

Select Financial Year: Choose the fiscal twelvemonth for which you privation your taxes to beryllium calculated.

Select Age Group: Select your property group. This is due to the fact that taxation liability arsenic per the authorities rules is based connected the property of the income taxpayer.

Proceed to Next Step: Click connected ‘Go to Next Step’.

Enter Taxable Salary (Old Tax Slabs): Enter your taxable wage aft deducting exemptions specified arsenic HRA, LTA, etc.

Story continues beneath this ad

Enter Gross Salary (New Tax Slabs): Enter your wage without deducting exemptions specified arsenic HRA, LTA, nonrecreational tax, etc.

Provide Additional Income Details: Enter details specified arsenic involvement income, rental income, involvement paid connected a location indebtedness for rented property, and involvement paid connected a indebtedness for self-occupied property.

Income from Digital Assets: For income from integer assets, participate the nett income (sale information minus the outgo of acquisition). This income is taxed astatine 30% positive applicable surcharge and cess.

Proceed to Next Step Again: Click connected ‘Go to Next Step’ again.

Story continues beneath this ad

Tax Saving Investments (Old Tax Slabs): If you privation to cipher your taxes nether the aged taxation slabs, participate your tax-saving investments nether sections 80C, 80D, 80G, 80E, and 80TTA.

Calculate Tax Liability: Click connected ‘Calculate’ to get your taxation liability. You volition besides spot a examination of your pre-budget and post-budget taxation liability nether some the aged and caller taxation slabs.

Non-Applicable Fields: Enter “0” for immoderate fields that bash not use to you.

2 hours ago

2

2 hours ago

2

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·