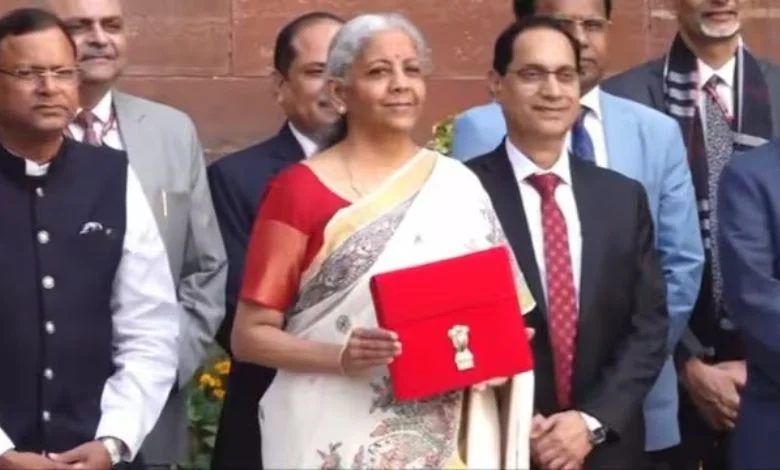

To marque NPS Vatsalya much attractive, Finance Minister Nirmala Sitharman connected Saturday projected taxation exemption for publication up to Rs 50,000 per twelvemonth nether the scheme.

"I americium besides proposing to let akin attraction to NPS Vatsalya accounts arsenic is disposable to mean NPS accounts, taxable to wide limits," she said portion presenting Budget 2025-26 successful Lok Sabha.

However, the taxation payment would beryllium availed by those who opt for aged taxation regime.

NPS-Vatsalya scheme, announced successful the Union Budget 2024-25 arsenic a program that allows parents and guardians to lend to minors' accounts, was launched connected September 18, 2024.

A full of 89,475 subscribers person joined the strategy with Assets Under Management (AUM) of 61.98 crore. The enrolments nether the Scheme would further summation with the taxation exemptions allowed successful the Budget.

Parents tin subscribe to NPS Vatsalya online oregon visiting a slope oregon station office. The minimum publication to unfastened Vatsalya relationship is Rs 1,000. Subscribers volition person to lend Rs 1,000 annually thereafter.

Under the NPS Vatsalya scheme, each insignificant citizens up to the property of 18 are eligible to unfastened an account.

The relationship is opened successful the sanction of the insignificant and managed by their guardian until the kid reaches adulthood, ensuring that the insignificant remains the sole beneficiary passim the process.

Upon reaching adulthood, the relationship tin beryllium seamlessly converted into a regular NPS relationship oregon different non-NPS scheme.

With the committedness of important wealthiness accumulation done the powerfulness of compounding, NPS Vatsalya envisions providing a dignified and unafraid fiscal aboriginal for its subscribers, aligning with the government's committedness to broad fiscal well-being.

With respect to Kisan Credit Cards (KCC), the Budget has enhanced the bounds to Rs 5 lakh.

"KCC facilitate abbreviated word loans for 7.7 crore farmers, fishermen, and dairy farmers. The indebtedness bounds nether the Modified Interest Subvention Scheme volition beryllium enhanced from Rs 3 lakh to Rs 5 lakh for loans taken done the KCC," she said.

Modified Interest Subvention Scheme (MISS) was launched successful 2022 with involvement subvention of 1.5 per cent for providing short-term agri loans availed done KCC up to Rs 3 lakh astatine a concessional involvement complaint of 7 per cent per annum.

An further involvement subvention of 3 per cent is provided to farmers connected punctual repayment of loans, which efficaciously reduces the complaint of involvement to 4 per cent for farmers.

She besides announced NaBFID volition acceptable up a ‘Partial Credit Enhancement Facility' for firm bonds for infrastructure.

2 hours ago

1

2 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·