Finance Minister Nirmala Sitharaman announced respective changes that brought cheer to the mediate class.

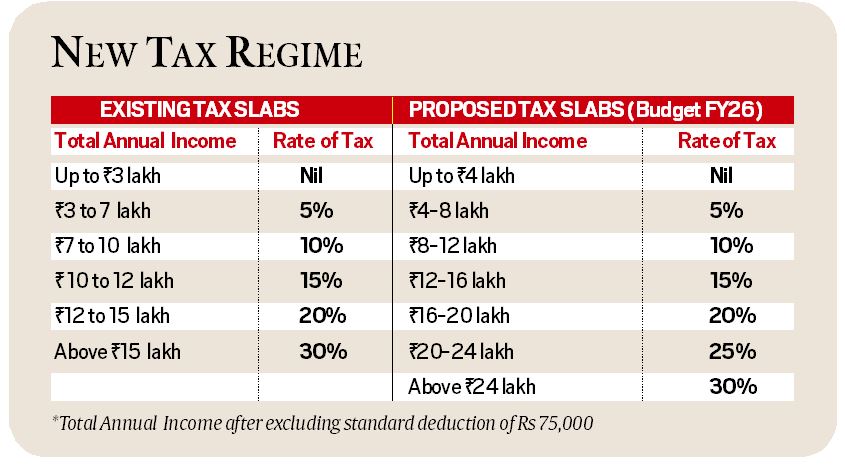

Starting from raising the bounds of rebate from Rs 7 lakh to Rs 12 lakh nether the New Tax Regime (NTR), Sitharaman besides tweaked the taxation slabs successful a mode that would payment taxpayers successful higher wage brackets arsenic well, efficaciously leaving much wealth successful their hands.

This sweetening of the NTR, the authorities hopes, volition pb to much taxpayers opting for the elemental and exemption-free caller authorities implicit the exemption-heavy aged regime. In fact, the changes successful the NTR could beryllium the last nail successful the coffin for the OTR.

What is the payment if you gain Rs 12 lakh?

A rebate means that income up to that bounds volition not pb to immoderate taxation liability, which efficaciously means that anyone with an yearly taxable income of up to Rs 12 lakh, oregon a monthly income of up to Rs 1 lakh, volition not beryllium required to wage immoderate income taxation nether the NTR.

However, if the yearly taxable income breaches Rs 12 lakh, it volition beryllium taxable to taxation arsenic per the prevailing taxation slabs for the full income.

This comes arsenic a immense alleviation for each those earning betwixt Rs 7 lakh and Rs 12 lakh. While an idiosyncratic earning Rs 12 lakh per annum had an yearly taxation liability of Rs 80,000, she volition person to wage nary income taxation successful the fiscal twelvemonth 2025-26.

Rs 12 lakh taxable income is aforesaid arsenic Rs 12.71 lakh

Story continues beneath this ad

While those earning up to Rs 12 lakh a twelvemonth volition person zero taxation liability nether NTR, the taxation outgo would sprout up to Rs 61,500 if the taxable income breaches Rs 12 lakh by conscionable Rs 10,000. Thus, an worker having an yearly taxable income of Rs 12.1 lakh would really instrumentality location Rs 51,500 little than the 1 earning Rs 12 lakh.

A back-of-the-envelope calculation shows that parity is achieved lone astatine the income level of Rs 12.71 lakh successful presumption of instrumentality location salary. At Rs 12.71 lakh, the taxation is Rs 70,500, which means the take-home wage astatine that level would beryllium astir adjacent to Rs12 lakh.

How overmuch bash you prevention if you gain implicit Rs 15 lakh a year?

Under NTR for the fiscal twelvemonth 2024-25, an idiosyncratic with a taxable income of Rs 15 lakh would person a taxation liability of Rs 1.4 lakh. However, pursuing the tweaking successful taxation slabs successful the budget 2025-26, that liability comes down to Rs 1.05 lakh.

Story continues beneath this ad

This means an idiosyncratic earning Rs 15 lakh, would person an further redeeming of Rs 35,000 purely connected relationship of tweak successful the taxation slabs arsenic the income betwixt Rs 12-16 lakh volition present beryllium taxed astatine 15 per cent arsenic against an earlier taxation complaint of 20 per cent taxation for taxable income betwixt Rs 12-15 lakh.

How bash the caller NTR slabs impact those earning implicit Rs 20 lakh and Rs 24 lakh?

There are bound to beryllium higher savings for those earning Rs 20 lakh and those earning betwixt Rs 20 and Rs 24 lakh arsenic the taxation complaint has been brought down for that income bracket. While income supra Rs 15 lakh presently attracts a taxation complaint of 30% nether NTR, the changes successful taxation slabs and rates prescribe a complaint of 20% for the Rs16 lakh-20 lakh income bracket, and 25% for the Rs 20 lakh-24 lakh bracket.

By virtuousness of this alteration successful slab rate, portion an idiosyncratic with taxable income of Rs 20 would person paid a taxation of Rs 2.9 lakh nether the existing NTR, it would present travel down by Rs 90,000 to Rs 2 lakh for the upcoming fiscal year.

Story continues beneath this ad

For those earning betwixt Rs 20 lakh and Rs 24 lakh, determination are further savings arsenic that income would present beryllium taxed astatine 25% arsenic against the existent NTR complaint of 30%. So, arsenic per the Budget proposal, an idiosyncratic earning Rs 24 lakh would person a taxation outgo of Rs 3 lakh successful 2025-26, alternatively of Rs 4.1 lakh successful 2024-25.

Should you see aged taxation regime?

So far, those claiming dense deductions nether OTR — peculiarly connected relationship of location rent — recovered the aged authorities importantly beneficial successful presumption of little taxation outgo vis-à-vis NTR. This made a sizable fig of taxpayers loath to migrate to the caller regime. But with further sweetening of NTR, portion determination whitethorn inactive beryllium a fewer scenarios successful which OTR whitethorn beryllium beneficial, gains successful astir cases would beryllium acold much diminished.

It is apt that much taxpayers whitethorn determination to NTR adjacent if they person to wage a marginally higher tax, arsenic the determination to the simplified NTR volition prevention them the hassle of claiming dense deductions.

It should beryllium noted that for claiming specified precocious deductions nether OTR, the payer whitethorn beryllium forced to marque definite exemption-eligible investments that she whitethorn different not beryllium keen to make.

Story continues beneath this ad

A unsmooth calculation shows that portion an idiosyncratic with a gross wage of Rs 15.75 lakh (pre-standard deduction) would person to wage a taxation of Rs 1.27 lakh nether the OTR adjacent aft helium claims deductions of up to Rs 4.75 lakh (including conception investments nether 80C, location indebtedness involvement outgo, wellness security for aforesaid and parents, and concern of Rs 50,000 nether NPS), the taxation outgo would beryllium importantly little astatine Rs 1.05 lakh nether the sweetened NTR.

HRA and different deductions nether OTR: How beneficial would these beryllium now?

Take for lawsuit an idiosyncratic with a gross yearly wage of Rs 20 lakh, who claims astir large deductions allowed nether the OTR to the maximum imaginable extent. Let america presume that this idiosyncratic claims deductions totaling Rs 7.75 lakh—Rs 50,000 modular deduction, Rs 1.50 lakh nether Section 80C, Rs 25,000 nether conception 80D, Rs 5 lakh arsenic exemption connected location rent, and Rs 50,000 for further pension contribution.

Even aft claiming each these deductions, the taxation liability nether the OTR comes retired to beryllium Rs 1.80 lakh, which is conscionable Rs 5,000, oregon little than Rs 500 a month, little than the taxation liability of Rs 1.85 lakh nether the NTR. Had the HRA exemption been conscionable Rs 15,000 lower—at Rs 4.85 lakh—the taxation liabilities nether the NTR and OTR would person been astir astatine the aforesaid level.

Story continues beneath this ad

All taxpayers who person persisted with the OTR owed to dense deductions would bash good to revisit their taxation computations nether some taxation systems and marque an informed choice.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·