With a rejig of Income Tax slabs, the anticipation is that the wealth saved volition travel backmost into the system done consumption, savings oregon investment, Union Finance Minister Nirmala Sitharaman said successful an interrogation with Doordarshan. She besides spoke astir the benefits of the New Tax Regime and the government’s capex plans. Edited excerpts:

The caller Income Tax Bill volition travel adjacent week. Will that beryllium successful the signifier of a draught and volition you instrumentality stakeholder comments connected it?

Any Bill goes to the lasting committee, aft which we volition consult with stakeholders. It volition past instrumentality to us, and if necessary, further amendments volition beryllium made earlier moving it guardant to the House.

Is determination a circumstantial crushed for expanding the income taxation rebate from Rs 7 lakh to Rs 12 lakh? Was it due to the fact that incomes and salaries were not increasing arsenic expected, prompting the authorities to present this rebate? Additionally, however volition you compensate for the Rs 1-trillion gross loss? Won’t this interaction budget estimates? Where volition the funds travel from?

Income has to turn to a definite level earlier a treatment astir taxation becomes relevant. Now, wherefore summation the threshold from Rs 7 lakh to Rs 12 lakh? It was earlier Rs 2.2 lakh, past successful 2014, it became Rs 2.5 lakh. In 2019, it was raised to Rs 5 lakh, past to Rs 7 lakh, and present to Rs 12 lakh. The authorities feels that if idiosyncratic earns Rs 1 lakh per period connected average, they should not person to wage tax.

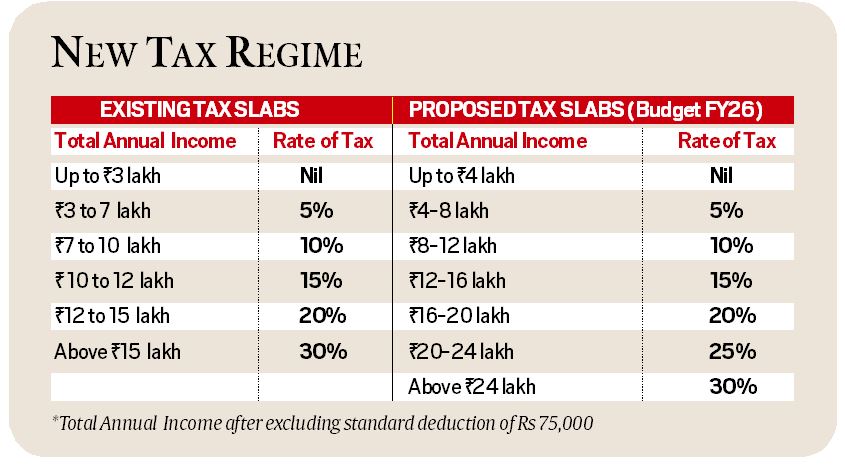

We are doing this successful 2 ways: One, we are reducing slab rates — the taxation slabs are present much uniform, with a gradual progression. Two, we are expanding taxation slabs — this benefits each taxpayers, arsenic the revised slabs supply alleviation crossed income groups.

Additionally, the Finance Ministry decided that immoderate radical should person other benefits beyond specified slab complaint reductions. Hence, an other rebate was introduced. Slab complaint reductions use to everyone, and other rebate for immoderate much people. Why bash this? The anticipation is that the wealth saved by taxpayers volition travel backmost into the system done consumption, savings, oregon investment.

Capex is besides continuing. I’ve not foregone capex to springiness for gross expenditure oregon depletion expenditure, truthful some continue… Even successful the coming year, effectual superior expenditure, including what Government of India provides states for superior expenditure, is 4.3% of GDP, 1 of the highest

Story continues beneath this ad

If you comparison what we person done contiguous with what prevailed successful 2014 nether the Congress government, the communicative has ever been astir putting wealth backmost into the hands of the people. Compared to the 2014 taxation rates nether Congress, idiosyncratic earning Rs 8 lakh present has astir Rs 1 lakh much successful their pocket. In 2014, the taxation was Rs 1 lakh; now, it is zero. Moreover, idiosyncratic earning Rs 12 lakh had to wage Rs 2 lakh successful 2014; now, it is zero. That means Rs 2 lakh much successful their pocket. Moreover, rates for everyone are being brought down. As a result, idiosyncratic earning Rs 24 lakh, who had to wage Rs 5.6 lakh successful 2014; present lone person to wage Rs 3 lakh. That means Rs 2.6 lakh much successful their pocket. So, it’s not conscionable those earning up to Rs 12 lakh who benefit—because they are not paying immoderate taxation astatine each owed to the rebate—but adjacent those earning much spot benefits.

On income taxation — since the process has been simplified, does this mean that aboriginal alleviation for taxpayers could beryllium provided done a scheduled oregon enforcement bid alternatively than waiting for a full-fledged income taxation bill?

Any clip alleviation is given, it volition person to spell done the Parliament. If we are providing fiscal relief, it requires approval. Tax simplification chiefly addresses complexity of language, the circuitous mode provisions were explained, and the excessive exemptions. When we introduced the caller taxation regime, we deliberately avoided replicating the aged one, which included respective exemptions. We wanted a simple, straightforward taxation authorities wherever rates could beryllium lowered. That is precisely what we person done now. The enactment itself needed simplification, and that is our attempt.

Disinvestment was not mentioned successful the past Budget oregon this one, though the people remains. Is determination immoderate renewed propulsion toward what was antecedently announced, specified arsenic the privatisation of banks?

Story continues beneath this ad

We person a worth instauration strategy. There is nary disinvestment people per se. Disinvestment and dividends are considered together, arsenic some impact money, and wealth is fungible. This strategy has 5 elements. First, show of cardinal nationalist assemblage enterprises (CPSEs). Second, effectual connection of that performance. Third, the superior expenditure of CPSEs, which is important for accelerating growth. Fourth, a accordant dividend policy. Fifth, a calibrated disinvestment strategy, wherever listing is besides a portion of disinvestment. Overall, some dividends and disinvestment rise astir Rs 80,000 to Rs 90,000 crore per twelvemonth successful a mode that benefits number shareholders.

How galore radical volition payment from the rebate summation from Rs 7 lakh to Rs 12 lakh? Additionally, portion the implicit capex fig has risen, galore reason that the gait of spending has slowed compared to erstwhile years. Does this bespeak a bounds to the government’s organization capableness for driving a capex push? Lastly, immoderate analysts suggest that the economical multiplier effect of capex is importantly higher than that of taxation cuts. How would you respond to these concerns?

One crore much radical volition wage nary tax. On capex, 2 factors are astatine play. First, this twelvemonth had the elections taking spot and due to the fact that of that, some cardinal and authorities governments were catching up with investments lone successful the 2nd and 3rd quarters. So it showed. It’s not arsenic if determination is nary thirst for superior expenditure, but present it volition beryllium astatine a gait astatine which you tin physique connected each 1 of the developments that you’ve done prior. So it volition continue. Some departments whitethorn necessitate much funds, portion others whitethorn scope a plateau, but spending volition proceed crossed sectors, ensuring concern successful plus creation.

How is capex continuing contempt gross and depletion expenditure, and what is its interaction connected GDP?

Story continues beneath this ad

Capex is besides continuing. I’ve not foregone capex to springiness for gross expenditure oregon depletion expenditure, truthful some continue. Look astatine what the wide numbers are. Even successful the coming year, effectual superior expenditure, including what Government of India provides states for their superior expenditure, is 4.3% of the GDP, 1 of the highest. It’s not conscionable what the Government of India’s departments spend, it is the full wealth that goes for superior expenditure. If you look astatine that compared to this year’s RE, determination volition beryllium a 20% increase. It is not a capableness issue, it is caller sectors coming up, for illustration the municipality sector, their locations are increasing. There’s 1 country that requires renewed focus.

So 1 is the capex that we springiness directly. The different is that grants that we springiness to authorities governments, for the authorities governments to bash capex, for example, Pradhan Mantri Gram Sadak Yojana, Pradhan Mantri Awas Yojana etc. So if you besides see the grants successful assistance for instauration of superior assets, the amount, the full magnitude has gone up to Rs 15.48 crore successful the fund estimation for adjacent year, which is much than 15% summation implicit the existent year’s RE, truthful that is simply a important increase. Whereas, if you see that the wide expenditure, that is gross positive capital, has grown by 7% successful the adjacent fiscal twelvemonth arsenic compared to this year’s RE, truthful this is astir doubly the aggregate maturation successful the expenditure. I would similar to besides adhd that connected apical of this Rs 15 trillion capex, the CPSEs adhd astir Rs 4 trillion capex from their ain resources. So that’s besides the capex which goes in. And that is not counted here.

The FDI bounds for security has been accrued from 74% to 100%. Have different recommendations successful the Insurance Amendment Bill been rejected?

Fundamentally, whether it’s 74% oregon 100% doesn’t matter. What matters is the intelligence feeling that they tin ain the institution 100%. Along with this, we are besides going to simplify definite procedures and rules that we frame, which includes cardinal absorption personnel, idiosyncratic who tin beryllium president of the company, and persons who tin beryllium the CEO and committee of directors, and besides the repatriation of dividends. The draught security Bill is the 1 that has been announced.

Story continues beneath this ad

Could you supply immoderate broader aspects of the broad plus monetisation program successful detail?

Until past year, the archetypal programme that was launched successful 2021, achievements person been of the bid of 90%, which is bully progress. Based connected that occurrence is our adjacent leap, astir treble the amount. Newer plus classes are besides coming up. For example, transmission assets, and not conscionable of the Government of India, but besides authorities authorities assets. An full program volition beryllium retired soon.

Considering the government’s measurement to enactment successful much wealth into the hands of the public, are you trying to mitigate the interaction of a imaginable Trump-led tariff commercialized warfare with the US? Are you relying much connected home accumulation to guarantee Indians person a shield from the US commercialized wars if they happen?

Well, I don’t deliberation we’ve gone that acold to warrant the income taxation complaint reduction. We’ve responded to the dependable of the people, made our ain assessments and therefore, we’ve fixed this. There was an allegation besides that we didn’t respond to what whitethorn travel done the US administration’s tariff decisions. I don’t deliberation these 2 are connected truthful no, we haven’t done it with that intent.

Story continues beneath this ad

Kisan Credit Card bounds has been enhanced to Rs 5 lakh. Any appraisal connected however this volition boost agrarian consumption?

This is to alteration those farmers who are doing commercialized cropping, they necessitate much harvest loans, it volition facilitate them. It is to assistance the farmer, not a measurement to boost agrarian consumption. The intent is to facilitate farmers to get harvest loans.

How galore taxpayers person moved to the New Income Tax authorities and does this mean we are phasing retired the Old Tax Regime?

75% person already moved to the New Tax Regime nether the idiosyncratic category.

Story continues beneath this ad

The Old Tax authorities is disposable but we expect astir everyone to displacement now. However, if we were phasing retired the aged scheme, I would person said so.

MGNREGA has seen stagnant allocation successful the past 2 years, contempt FY25’s utilisation having peaked till December. Do you expect a mid-year revision?

MNREGA is simply a demand-driven programme. If arsenic a effect of an summation successful demand, a authorities wants money, the RE shows the numbers and we summation it. But conscionable due to the fact that of that doesn’t mean that the BE volition person to beryllium connected the enhanced note. Every year, station the harvest season, the numbers vary. As a demand-driven programme, we volition surely respond to it arsenic and erstwhile the numbers come.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·