UPSC Issue astatine a Glance is an inaugural of UPSC Essentials to absorption your prelims and mains exam preparation connected an contented that has been successful the news. Every Thursday, screen a caller taxable successful Q&A format. This week’s contented is focused connected the Union Budget 2025-26. Let’s get started!

Union Finance Minister Nirmala Sitharaman presented the Union Budget 2025-26 connected Saturday (1st February). In her speech, she highlighted four engines of improvement for the 2025-26 fiscal year: agriculture, micro, small, and mean enterprises (MSMEs), investments, and exports. “The substance for this travel is provided by reforms, the guiding rule is inclusivity, and the destination is Viksit Bharat,” stated the Finance Minister. In this context, knowing the highlighted engines of maturation is crucial.

Why is the Union Budget relevant?

The Union Budget is simply a important constituent of the UPSC syllabus. Understanding its facts, figures, and investigation is importantly important for each signifier of the UPSC Civil Services Examination (CSE). Therefore, it is indispensable to recognize the Union Budget from a broader perspective.

UPSC Syllabus:

Preliminary Examination: Current events of nationalist importance, economical development

Mains Examination: General Studies-II, III: Indian Economy and issues relating to planning, mobilisation of resources, growth, improvement and employment, Government budgeting; Government policies and interventions for improvement successful assorted sectors and issues arising retired of their plan and implementation.

Question 1: What does the Union Budget accidental connected agriculture and however bash experts analyse it?

Agriculture, which supports much than 60 per cent of India’s population, is simply a large portion of the country’s agrarian economy. Finance Minister Nirmala Sitharaman Saturday said that agriculture was 1 of the 4 engines driving India’s improvement travel and announced respective caller initiatives for the sector. Some of the cardinal initiatives are:

1. Prime Minister Dhan-Dhaanya Krishi Yojana (PMDDKY): PMDDKY volition beryllium implemented successful collaboration with states, crossed 100 districts successful its archetypal phase. The strategy aims to summation cultivation productivity, follow harvest diversification and sustainable agriculture practices, amended post-harvest retention aft harvest astatine the panchayat and artifact levels, amended irrigation facilities, and supply short-term and semipermanent credit.

2. National Mission connected High Yielding Seeds: A National Mission connected High Yielding Seeds volition beryllium launched, aimed astatine (1) strengthening the probe ecosystem, (2) targeted improvement and propagation of seeds with precocious yield, pest absorption and clime resilience, and (3) commercialized availability of much than 100 effect varieties released since July 2024.

Story continues beneath this ad

3. Pulse Mission: The authorities has announced an allocation of Rs 1,000 crore for a six-year inaugural called the “Pulse Mission,” aimed astatine boosting pulse accumulation to execute self-sufficiency. This inaugural volition absorption connected 3 types of pulses: tur (arhar), urad (mash), and masoor.

4. Makhana committee for Bihar: A Makhana Board volition beryllium acceptable up successful Bihar to boost the cultivation and selling of fox nuts. The radical engaged successful Makhana cultivation volition beryllium organised successful FPOs. Bihar accounts for astir 90% of India’s makhana production.

5. Rural Prosperity and Resilience’ program: A holistic, multi-sectoral ‘Rural Prosperity and Resilience’ programme volition beryllium launched successful collaboration with states. This inaugural aims to tackle under-employment successful agriculture by promoting accomplishment development, investment, exertion adoption, and revitalization of the agrarian economy.

The large question from the agriculture conception of the Union Budget for FY26 is whether it tin bring successful clime resilience, and augment the productivity and incomes of farmers and workplace labourers. There are respective initiatives announced for agriculture that are apt to assistance the farming community.

Story continues beneath this ad

The peculiar absorption connected 100 districts to augment agri-productivity, beforehand sustainable farming practices and harvest diversification, extending recognition entree done Kisan Credit Cards from Rs 3 lakh to Rs 5 lakh, starting a Pulses Mission to attain atma nirbharta successful tur, moong and urad, etc., are each steps successful the close direction. So is the mounting up of a Makhana Board successful Bihar. How acold they volition spell successful achieving their objectives remains to beryllium seen.

While the Union Budget 2025-26 makes immoderate advancement successful addressing cultivation challenges, the wide attack remains incremental alternatively than transformational. A paradigm displacement is needed — 1 that moves distant from subsidy-heavy interventions towards investment-driven growth, greater backstage assemblage participation, and technology-led ratio improvements. The way to making Indian agriculture much resilient and globally competitory requires bold reforms successful subsidy rationalisation, infrastructure development, and marketplace linkages. Only past tin India execute the extremity of Vikshit Bharat and presumption itself arsenic an cultivation powerhouse by 2047.”

Question 2: What are the large announcements for India’s MSME assemblage successful the Union Budget, and what bash experts accidental astir it?

Giving caller definitions for micro, tiny and mean enterprises (MSMEs) and announcing a slew of initiatives to assistance specified businesses, Finance Minister Nirmala Sitharaman successful her Budget code termed them the 2nd powerfulness motor for development. It encompasses manufacturing and services with a absorption connected MSMEs numbering 5.7 crore. Several cardinal initiatives announced to code the challenges faced by the manufacturing sector, peculiarly for MSMEs are:

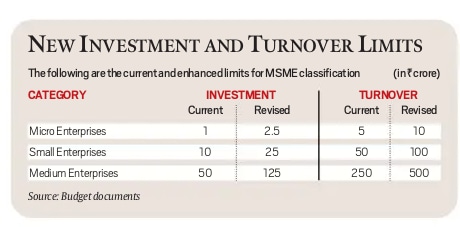

1. Definition of MSMEs widened: In her Budget speech, Finance Minister said the concern and turnover limits for classification of each MSMEs volition beryllium accrued 2.5 and 2 times respectively.

Story continues beneath this ad

This means the concern bounds to beryllium classified arsenic a micro endeavor goes up to Rs 2.5 crore. For tiny enterprises, this bounds goes up to Rs 25 crore, and for mean ones, it becomes Rs 125 crore. Similarly, the turnover bounds for these classifications goes up to Rs 10 crore for micro enterprises, Rs 100 crore for tiny ones, and Rs 500 crore for mean enterprises.

2. Credit Guarantee Limit Increased: The Union Finance Minister also announced the enhancement of the recognition warrant screen from Rs 5 crore to Rs 10 crore for micro and tiny enterprises, and from Rs 10 crore to Rs 20 crore for startups. As portion of the initiatives for MSMEs, she announced that a National Institute of Food Technology, Entrepreneurship and Management volition beryllium established successful Bihar.

3. Customised recognition cards: Customised recognition cards with a bounds of Rs 5 lakh were announced successful the Budget for micro enterprises registered connected the Udyam portal. In the archetypal year, 10 lakh of these cards volition beryllium issued.

4. National Manufacturing Mission: The Union Finance Minister said successful her Budget code that the Central authorities volition acceptable up a National Manufacturing Mission for small, mean and ample industries with a absorption connected cleanable tech manufacturing. The mission’s mandate volition see 5 absorption areas – easiness and outgo of doing business, upskilling for in-demand jobs, MSMEs, availability of technology, and prime products.

Story continues beneath this ad

5. Scheme for First-time Entrepreneurs: A caller strategy volition beryllium launched for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs. This volition supply word loans up to Rs 2 crore during the adjacent 5 years.

Union Finance Minister’s announcements for MSMEs has wide been welcomed by the sector.

The Economic Survey has rightly pointed retired the request to beforehand labour-intensive sectors with accomplishment upgradation truthful that their productivity, and thus, their incomes, improve. The organised manufacturing assemblage truthful acold has gone successful for much capital-intensive choices alternatively than labour-intensive ones. Deregulating MSMEs is 1 mode to determination guardant arsenic they make a bulk of employment successful the country, aft agriculture.- Ashok Gulati and Raya Das

The initiatives to code the backing and logistical challenges of the MSME assemblage purpose to supply bully momentum to an important portion of our economy; however, its execution is thing we request to hold and see.

Question 3: How does the Union Budget code investment-related challenges to stimulate economical growth?

Union Budget 2025 identifies concern arsenic the 3rd motor of India’s growth. It focuses connected investing successful people, the economy, and innovation. The pursuing initiatives person been announced successful the budget:

Story continues beneath this ad

1. Urban Challenge Fund: The Government volition found a ₹1 lakh crore Urban Challenge Fund to enactment initiatives similar ‘Cities arsenic Growth Hubs,’ ‘Creative Redevelopment,’ and ‘Water & Sanitation’. The money volition screen up to 25% of viable task costs, requiring astatine slightest 50% backing from bonds, slope loans, oregon PPPs. ₹10,000 crore is allocated for 2025-26.

2. Public Private Partnership successful Infrastructure: Each infrastructure-related ministry volition travel up with a 3-year pipeline of projects that tin beryllium implemented successful PPP mode. States volition besides beryllium encouraged to bash truthful and tin question enactment from the IIPDF (India Infrastructure Project Development Fund) strategy to hole PPP proposals.

Support to States for Infrastructure.

3. FDI successful Insurance Hiked: Union Finance Minister announced a important hike successful overseas nonstop concern (FDI) successful the security assemblage — from 74% to 100% — paving the mode for the introduction of planetary security giants, important overseas investments and pugnacious contention successful the Indian market. Foreign investments volition besides supply much-needed superior to the Indian security sector, enabling insurers to connection amended products and services.

4. SWAMIH Fund 2: It volition beryllium established arsenic a blended concern installation with publication from the Government, banks and backstage investors. The existing Special Window for Affordable, Mid-Income Housing (SWAMIH) strategy aims to assistance middle-class families who wage EMIs connected loans taken for apartments, and rent connected their existent dwellings.

Story continues beneath this ad

5. Nuclear Energy Mission for Viksit Bharat: A Nuclear Energy Mission for probe & improvement of Small Modular Reactors (SMR) with an outlay of Rs. 20,000 crore volition beryllium acceptable up. At slightest 5 indigenously developed SMRs volition beryllium operationalized by 2033.

6. Deep Tech Fund of Funds: Investing successful innovation the fund announced a ‘Deep Tech Fund of Funds’ for adjacent procreation startups and 10 1000 PM probe fellowships for technological probe successful IITs and IISc successful adjacent 5 years.

7. Maritime Development Fund: This money volition beryllium acceptable up with a corpus of Rs 25,000 cr. It volition enactment the semipermanent financing of the maritime industry. Aims astatine distributing enactment and promoting competition. Upto 49% GoI support, remainder by ports, backstage sector.

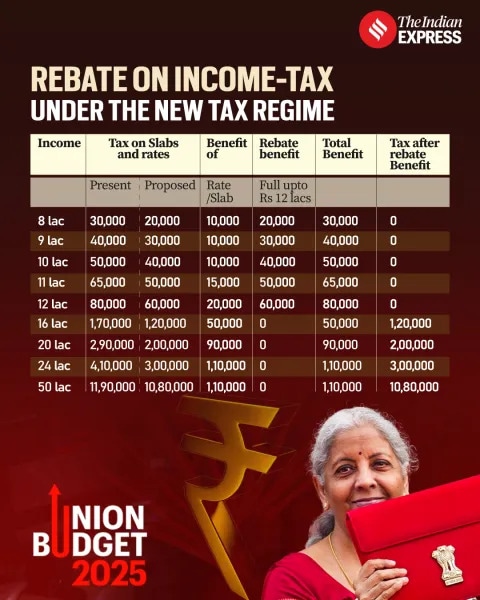

8. Historic Tax Cut: The concern curate has raised the bounds of income taxation rebate from Rs 7 lakh to Rs 12 lakh, which fundamentally means that if an idiosyncratic has an income of up to Rs 12 lakh, she volition person zero taxation liability.

Udit Mishra writes- “Many observers person pointed retired that companies were unwilling to put successful caller capacities until they could beryllium definite determination was capable request successful the system for their products.

Saturday’s Budget announcement of a monolithic income taxation interruption is an acceptance by the authorities that much than thing else, the backstage assemblage investments necessitate robust user demand. Almost everything other — firm income taxation and involvement rates and the information of roads — is secondary.

The anticipation present is that consumers volition walk the further wealth successful manus — astir Rs 1 lakh crore that the authorities is foregoing arsenic revenues — and that this volition supply corporates with the indispensable crushed to put successful caller capacities, make jobs, and further spur economical growth.

However, determination is simply a important constituent inactive lacking successful the Budget: a broad strategy for economical maturation without which taxation cuts volition not beryllium enough.”

Nilesh Shah writes– “The fund has invested successful the aboriginal by allocating Rs 10,000 crore for a start-up Fund of Fund scheme; Rs 25,000 crore for shipbuilding done a Maritime Development Fund; and Rs 20,000 crore for tiny modular atomic reactors. All these investments are futuristic and could person a multiplier effect connected the economy.

Markets are driven by flows, sentiments, and fundamentals. This fund volition support affirmative home capitalist sentiment, promote home flows to the superior market, and amended firm profits implicit time.”

Question 4: How does the Union Budget align with India’s extremity of becoming a planetary export hub?

Finance Minister Nirmala Sitharaman identified exports arsenic a cardinal motor for improvement implicit the coming year. To this end, she announced 5 initiatives:

1. Export Promotion Mission: This ngo volition beryllium driven jointly by the Ministries of Commerce, MSME, and Finance. It aims to facilitate casual entree to export credit, cross-border factoring support, and enactment to MSMEs to tackle non-tariff measures successful overseas markets.

2. BharatTradeNet: A integer nationalist infrastructure, ‘BharatTradeNet’ (BTN) for planetary commercialized volition beryllium acceptable up arsenic a unified level for commercialized documentation and financing solutions. The BTN volition complement the existing Unified Logistics Interface Platform, which allows manufacture players to entree logistics-related datasets from assorted authorities systems.

3. Global Supply Chain Integration: Support home manufacturing to integrate India’s system into planetary proviso chains, focusing connected Industry 4.0 and younker talent.

4. National Framework for Global Capability Centres: As guidance to states for promoting Global Capability Centres (GCCs) successful emerging tier 2 cities. GCCs connection enactment to MNCs. The projected argumentation aims astatine enhancing availability of endowment and infrastructure, building-byelaw reforms, and mechanisms for manufacture collaboration.

5. Warehousing installation for aerial cargo: To facilitate the upgradation of infrastructure and warehousing for aerial cargo including high-value perishable horticulture produce.

In the discourse of planetary uncertainty, the export-related initiatives of authorities clasp large importance, arsenic they not lone find economical gains but besides signifier our planetary relations.

Rajat Kathuria and Neha Gupta wrote connected January 30 successful The Indian Express – “Although the Union fund is not the champion spot to look for trade-related announcements, it has go 1 of the respective platforms that communicates India’s argumentation engagement with the planetary economy.

Unquestionably, argumentation instability takes its toll connected exports and FDI. India’s export maturation remains stagnant; its stock successful planetary exports lingers astir 2 per cent… Trade argumentation requires broad reform, including the constitution of a dedicated committee to guarantee argumentation consistency and to formulate an enactment program to execute the nonsubjective of $2 trillion successful exports by 2030.

In this regard, the caller declaration by the CEO of NITI Aayog that “India is 1 of the fewer (big) economies which is not a portion of ample commercialized agreements” needs superior evaluation. Mega commercialized blocs specified arsenic the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) are reshaping planetary trade, but India is ambivalent astir their utility.

However, a connection of caution. By itself, commercialized openness volition not present unless accompanied by home betterment to region structural deficiencies. All things considered, a re-evaluation of the pessimism surrounding commercialized agreements is called for.”

Post Read Questions

Prelims

(1) Consider the pursuing statements:

1. Revenue expenditure does not effect successful the instauration of assets for the Government of India.

2. Capital expenditure reduces the government’s liability oregon increases the government’s assets.

Which of the statements fixed supra is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

(2) Along with the Budget, the Finance Minister besides places different documents earlier the Parliament which see ‘The Macro Economic Framework Statement’. The aforesaid papers is presented due to the fact that this is mandated by (UPSC CSE 2020)

(a) Long-standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

(3) With notation to the Union Government, see the pursuing statements: (UPSC CSE 2015)

1. The Department of Revenue is liable for the mentation of the Union Budget that is presented to the Parliament.

2. No magnitude tin beryllium withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India.

3. All the disbursements made from Public Account besides request the authorization from the Parliament of India.

Which of the statements fixed supra is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

(4) There has been a persistent shortage fund twelvemonth aft year. Which action/actions of the pursuing tin beryllium taken by the Government to trim the deficit? (UPSC CSE 2016)

1. Reducing gross expenditure

2. Introducing caller payment schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the close reply utilizing the codification fixed below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

Mains

(1) Distinguish betwixt Capital Budget and Revenue Budget. Explain the components of some these Budgets. (UPSC CSE 2021)

(2) What were the reasons for the instauration of Fiscal Responsibility and Budget Management (FRBM) Act, 2003? Discuss critically its salient features and their effectiveness. (UPSC CSE 2013)

(Sources: PM Dhan-Dhaanya, New urea works to travel up successful Assam, Ashok Gulati, Raya Das connected Budget 2025, National Manufacturing Mission MSME soon, Definition of MSMEs widened, recognition warrant bounds increased, FDI successful security hiked to 100%, paving mode for introduction of overseas giants, Union Budget 2025 Explained Highlights, Union Budget 2025 : Key highlighs, Critics don’t get it — escaped commercialized is bully for India)

For your queries and suggestions constitute at roshni.yadav@indianexpress.com

🚨New Year Special: Click Here to work the January 2025 issue of the UPSC Essentials monthly magazine. Share your views and suggestions successful the remark container oregon at manas.srivastava@indianexpress.com🚨

Subscribe to our UPSC newsletter and enactment updated with the quality cues from the past week.

Stay updated with the latest UPSC articles by joining our Telegram transmission – Indian Express UPSC Hub, and travel america on Instagram and X.

3 hours ago

3

3 hours ago

3

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·