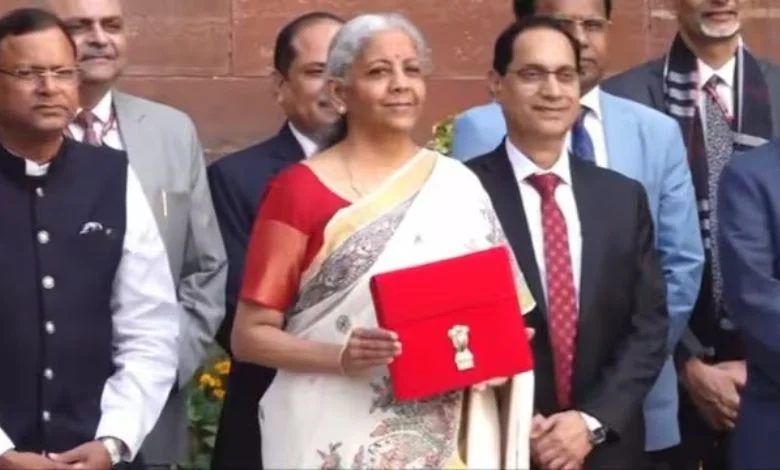

Finance Minister Nirmala Sitharaman presented the Union Budget 2025 connected Saturday, February 1, outlining cardinal measures to enactment savings schemes, peculiarly benefiting elder citizens and National Pension System (NPS) subscribers.

Fiscal shortage and borrowing plan

To concern the fiscal deficit, the nett marketplace borrowings from dated securities are estimated astatine Rs 11.54 lakh crore. The remaining funds volition beryllium sourced from tiny savings and different avenues, with gross marketplace borrowings projected astatine Rs 14.82 lakh crore.

Relief for Senior Citizens with aged NSS accounts

Recognising that galore elder and precise elder citizens clasp aged National Savings Scheme (NSS) accounts wherever involvement is nary longer payable, the authorities has projected a large relief. Sitharaman announced that withdrawals from these accounts made connected oregon aft August 29, 2024, volition beryllium exempt from taxation.

Exemption connected NSS withdrawals

The fund proposes taxation exemption for withdrawals made from NSS accounts aft August 29, 2024. This applies to some the main magnitude deposited and the accrued interest, provided deductions were antecedently claimed nether the scheme.

Parity for NPS Vatsalya accounts

Additionally, the Finance Minister projected extending akin taxation attraction to NPS Vatsalya accounts, aligning them with regular NPS accounts, taxable to wide publication limits. This determination is aimed astatine ensuring uniformity and enhancing benefits for NPS subscribers.

These announcements are expected to supply important alleviation to retirees and semipermanent savers, making tiny savings schemes much charismatic and beneficial.

3 hours ago

1

3 hours ago

1

.png)

.png)

.png)

.png)

English (US) ·

English (US) ·  Hindi (IN) ·

Hindi (IN) ·